Hi Robert,

This is a stock we haven’t looked at for a while, although we used to own it in the Income Portfolio some years ago. Their earnings are actually expected to trend down from here as can be seen on the company page of the Market Matters site under forecasts – here, however, this will be offset by the excess capital they have on their balance sheet i.e. lower earnings offset by the prospect of capital returns including ongoing share buy-backs and high dividends, forecast to be above 7.5% over the coming 12-months.

Their earnings are driven by the proportion of loans that are high LVR, and therefore need Lenders Mortgage Insurance (LMI) while they will also be impacted by the first home guarantee scheme rolled out from the Federal Government. Given they are an insurance company, bonds yields increasing has been positive for them and we expect higher yields to remain for some time yet. However, looking forward, if we do see higher delinquencies as unemployment rises (at some point), and bond yields fall, that could pressure HLI .

Around $3.50 this looks fully valued to us.

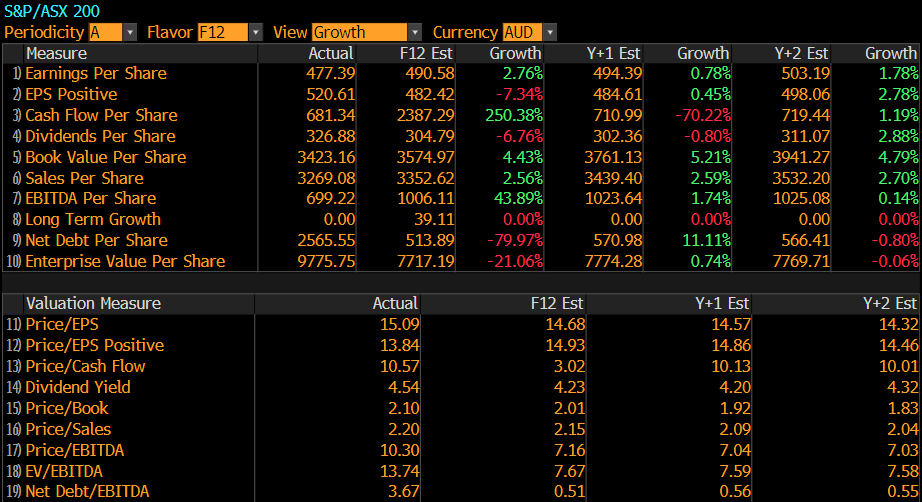

In terms of market EPS, we have included a handy chart from Bloomberg that looks at actual then forecasted metrics for the ASX 200. Consensus expects very slight earnings growth over the coming 2-years.