What Matters Today in Markets: Listen Here each morning

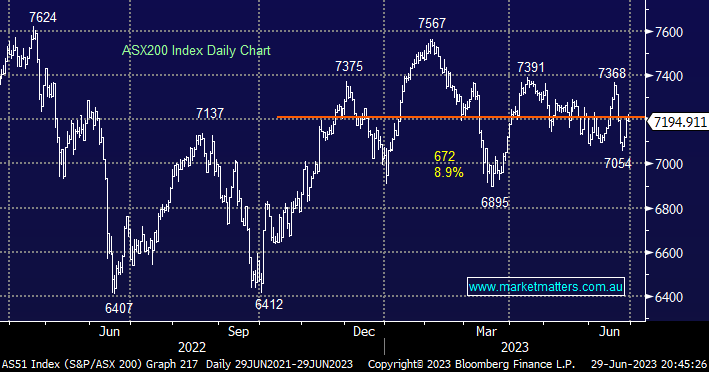

The ASX200 closed basically unchanged on Thursday leaving the index up over +10%, excluding dividends, with just today remaining of FY23, again equities look set to outperform cash although they have tested our nerves at times. Yesterday’s gains were again focused on the Tech Sector which has rewarded investors admirably over the last 6 months e.g. Xero (XRO) +63%, Wisetech (WTC) +53% and NEXTDC (NXT) +36% – no great surprise with the US NASDAQ enjoying its best 1H in 40-years. However, as markets try and 2nd guess when central banks will end their most aggressive tightening cycle in history we’ve seen some signs of performance reversion:

- MM believes the Tech Sector has further upside but it’s likely to become 3 steps forward, 2 steps back in nature, as the advance matures.

- We believe a number of select underperforming stocks can play some catch-up and shine in the 2H if/when central banks take their foot off of the accelerator.

At 2.30 pm next Tuesday the RBA will make their next decision on interest rates with a hike from 4.1% to 4.35% a coin toss according to interest rate markets, we can see 1-2 more hikes before Christmas but when is anyone’s guess – Dr Phillip Lowe has said they will be data dependant but now there are signs that inflation is slowing, while the economy is still proving resilient.

- We think the RBA will hike on Tuesday and then stand back and reassess but we’ve been wrong before in 2023 – one more hike would make it 13 hikes from 14 meetings!

- The Official Cash Rate is already at its highest level in over 11 years, with the mortgage cliff starting to bite we believe the economy is about to slow dramatically dragging down inflation.

People, similar to stock markets hate uncertainty but once we all feel confident the RBA has finished its hiking cycle the new market equilibrium will become apparent, it might not be as bad as many fear especially if the jobs market remains strong. Bar the COVID blip a large number of Australians have had no experience of recession with the last real recession ending over 30 years ago, we are 50-50 on whether the RBA can reduce inflation without causing the “Big R word” with China’s recovery a huge factor beyond the control of Philip Lowe et al – demand for commodities driven by the energy transition could well save us!

This morning the SPI Futures are pointing to a +0.2% gain following a mixed session on Wall Street where the Financials offset losses in the high-flying Tec Sector, the sector rotation was caused by banks passing their annual stress tests, a relatively strong jobs report & GDP data which showed the economy is in better shape than many feared which in turn increased the markets bets on further tightening.

- We continue to expect most action to unfold under the hood as the market continues to 2nd guess where the central bank’s rate hiking cycle will conclude.