Shaw & Partners hosted a graphite conference last week with a number of companies, including Syrah, presenting the outlook for the commodity and their assets. Graphite is a key battery metal but also has applications across steelmaking, lubricants and brakes to name a few. For this reason, graphite hasn’t quite had the major price rush as lithium despite making up a significant portion of what is now the global standard in batteries used in EVs and energy storage given the portion of supply in the global market being directed this way has been lower than that seen in the lithium market. The graphite market is at a turning point though with around two-thirds of demand now coming from the battery market with demand set to outpace supply and force prices higher.

Syrah owns the Balama natural graphite mine in Mozambique and is in the process of bringing a downstream anode processing facility in Louisiana. Production at Balama has been paused since May until market conditions improve, unlikely to be back up and running before the end of the September quarter which is likely to hold shares back in the near term. Their Louisiana plant is shaping up to be transformational for the company which would become the only large-scale active anode material facility outside of China. They have US Government support and a reasonable cash balance available to the commissioning, supported by a restart of production in Balama if the market improves before year-end.

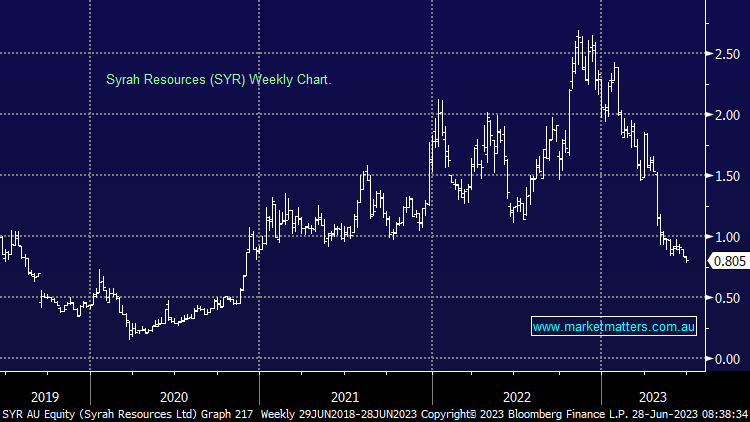

- We are watching the graphite market with interest with Syrah on the radar as a result.