Markets fall further than we thought, what now? (MQG)

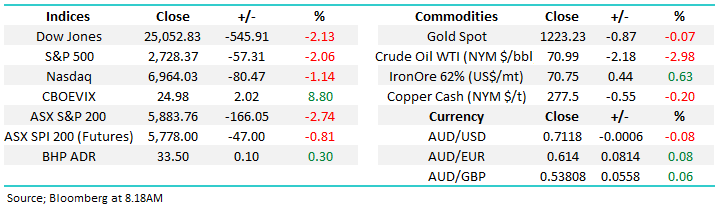

The ASX200 followed global indices aggressively lower yesterday finally closing at 5883, way under our targeted 5960 area, the picture clearly looks different just 24-hours after we woke up excited to see the Dow fall 800-points when MM was sitting on cash looking to buy weakness.

Today’ s report is simply going to update how we see markets moving forward and most importantly how we intend to invest while maintaining a very vigilant eye on the risk / reward side of the equation.

Overseas stocks have again fallen with the Dow closing down another 545-points / 2.1% although it did manage to bounce ~150-points from the intra-day low. The SPI futures are down -47pts however given where our cash market closed yesterday, and the selloff in our before they closed, the ASX200 could be down around 90-points early today testing the psychological 5800 area – feels too much on the downside for me.

Yesterday simply huge selling hit our market after 4pm, the same volume we can sometimes see in a whole days trade of futures. While (assuming the market opens where futures are suggesting) the market is now oversold, given the volume of selling yesterday afternoon it’s hard to see the market storming up above the 6000-level anytime soon.

ASX200 Chart

Firstly, looking at our index as we said previously the degree of correction has clearly been deeper than anticipated hence we must consider 2 options:

1 – Where is the markets likely “bottom” – our preferred scenario is now a choppy period of consolidation.

This implies we should still buy panic weakness but be prepared to increase cash again into strength

2 – Is this the “big one” we have been targeting? Looking at assets other than equities suggests not. This is an equity correction at this stage, we’re not seeing any concerning movements in the credit markets that matter. Some high yield credit spreads have widened a touch, but not significantly so. Panic is focussed in equities which implies this correction stems from growth concerns.

This morning the local market is likely to be down -9% from the August high – a significant correction. While the fundamental picture has not changed, the aggressive nature of selling paints a negative technical picture. This is not generally that surprising i.e. mixed signals during corrections between fundamental and technical measures. We prefer to take the technical view on board into market panic, given that price action can often be a strong leading indicator for a change fundamentally. i.e. equities pricing lower global growth etc.

We will give the market the slight benefit of the doubt over the next few weeks but we will have no hesitation moving back to a large cash holding if we deem appropriate from a risk perspective.

Clearly, these markets are designed for the active investor, opportunities will abound but so will major pitfalls, just consider the Australian growth stocks over the last few weeks.

ASX200 Chart

US stocks

Two major pieces of global macro-economic news have gathered momentum over the last few days to undo stocks i.e. rising US – China trade tensions and increasing bond yields (interest rates). Not fresh news but very significant with regard to share price valuations.

Importantly in MM’s opinion the Australian markets is around fair value but US stocks remain “rich” even after the last few days carnage.

Remember 3 facts from the September Bank of America Fund Managers Survey:

1 – Cash levels are at an 18-months high hence the buy buttons will be pressed at some stage leading to a strong bounce in stocks.

2 – Allocations to US equities was at an aggressive 21% overweight level – clearly the US has some room to underperform

3 – Allocations to emerging markets were sitting at 10% underweight, compared to 43% overweight in April, at the lowest level since March 2016 just before stocks soared.

We have been speculating that investors have been treating US stocks as an almost “safe haven” over recent months, a positioning fraught with danger and I add one we still believe accurate.

Hence with investors complacently long US stocks, pushing them to high valuations it’s no surprise that we are witnessing a sharp correction – For that reason we will maintain our 5% weighting in the Growth Portfolio in the leveraged US Bear ETF which gained over 10% yesterday.

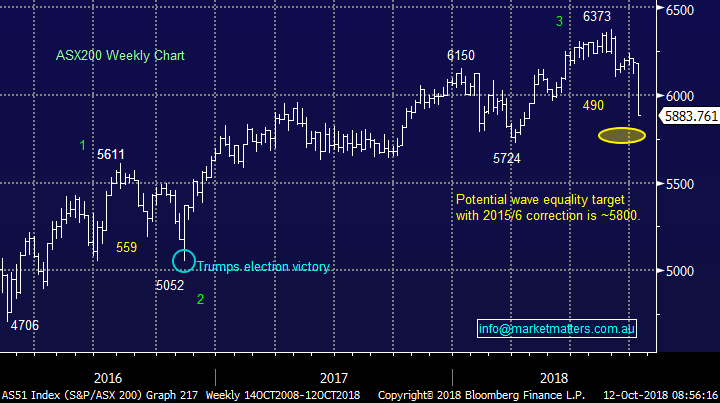

One thing caught my eye this morning is the panic in the market, illustrated by the VIX below, is current way under that of February / March, up there with BREXIT but almost orderly at this stage.

US Fear / Volatility (VIX) Index Chart

Technically the US stock market is clearer than our own and it looks weak in the short-term - the S&P500 is generating an excellent technical sell signal.

MM are technically bearish the US S&P500 targeting the 2550 area, or another 5-6% lower after its generated a technical sell signal. Hence, we will not be taking profit on our BBUS short US stock ETF at this stage.

Some interesting statistics dropped into my inbox yesterday and in a nutshell the conclusion was the S&P500 may well fall hard for the next few days BUT it’s usually higher both a week and 3-months later following Wednesday night’s 800-point plunge.

As we suggested yesterday afternoon, seasonally this is a good time to buy stocks assuming of course we catch the falling knife at the correct time with the above suggesting ~5% lower in the US.

US S&P500 Index Chart

Stocks / positions for MM

In hindsight we may have deployed some capital into the market a touch early yesterday, how now more importantly how do we move forward, especially with the index falling below our targeted 5960 level. When we stand back and look at the stocks MM is holding we feel relatively comfortable.

One stock we have been patiently waiting for is Macquarie below $116, its arrived very quickly and we still believe it represents good buying at these levels – however given the actions we took yesterday, we will hold fire for now.

On the other side of the fence positions we are holding that we may trim / sell are Ramsay Healthcare (RHC), Healthscope (HSO), Suncorp (SUN) plus Janus Henderson (JHG) which needs to recover soon!

Lastly following golds huge $US34 rally overnight we are watching our Newcrest (NCM) position closely, we would take profit around $22 or ~13% higher.

Macquarie Group (MQG) Chart

Conclusion

The longest bull market is showing signs of wilting under the pressure but with it comes great opportunity.

Remember if in any doubt, send in questions, we are here to support our subscribers

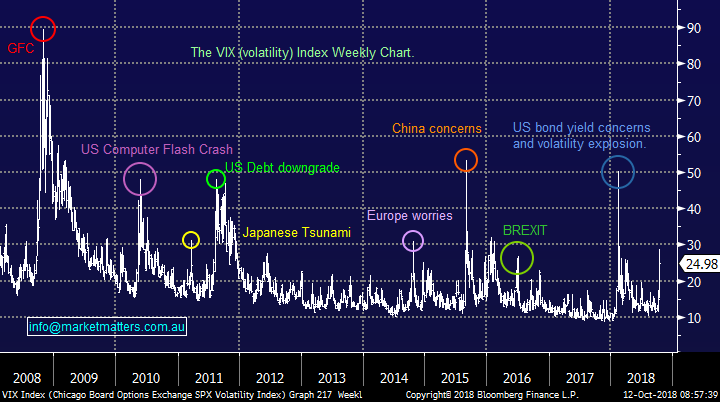

Overnight Market Matters Wrap

· The US major equities sold off another leg lower overnight, with volatility hitting levels back during Brexit talks in 2016 and European woes in 2014.

· It was evident that investors turned their backs on the equities side, and flocked back to the ‘safe haven’ assets with gold and the US government bonds outperforming again other asset classes, with US ten year bonds rallying from 3.2% to 3.14% after weaker than expected US CPI numbers, and gold had one of its strongest periods this year, soaring to US$1223.23/oz.

· Oil on the other hand slid nearly 3% with crude oil hitting US$70.99/bbl. and base metals were generally weaker with copper down about 0.5% at US$2.76/lb. BHP is expected to outperform the broader market today, after ending its US session up an equivalent of 0.30% from Australia’s previous close.

· The December SPI Futures is indicating the ASX 200 to open a further 90 points lower this morning, towards the 5800 level.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 12/10/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.