Yesterday’s webinar is now available on the MM website for those that missed it: Click Here

Several points were raised by the expert panel most of which we agree with and have flagged throughout the year, the following points were arguably the largest takeaways:

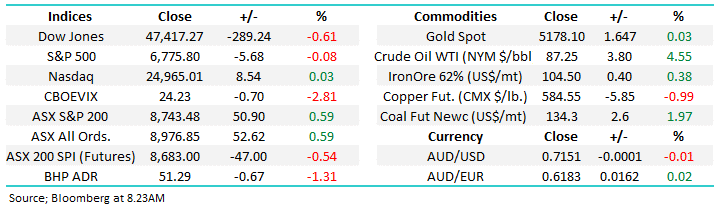

- Global miners simply haven’t reinvested in future production preferring to reward shareholders with sugar-hit buybacks & large dividends – major supply problems are looming on the horizon.

- Decarbonisation/electrification is going to increase demand significantly for many commodities over the next decade with copper one of our top picks.

- The current weakness in prices as China limps out of COVID lockdowns and investors worry about a potential recession in the coming quarters is providing an excellent opportunity to establish exposure for the long haul.

China has started to stimulate their economy this week and we are considering adding to our already ~30% stance in our Flagship Growth Portfolio hence today’s report is focused specifically on how we might tweak/add to our positions.