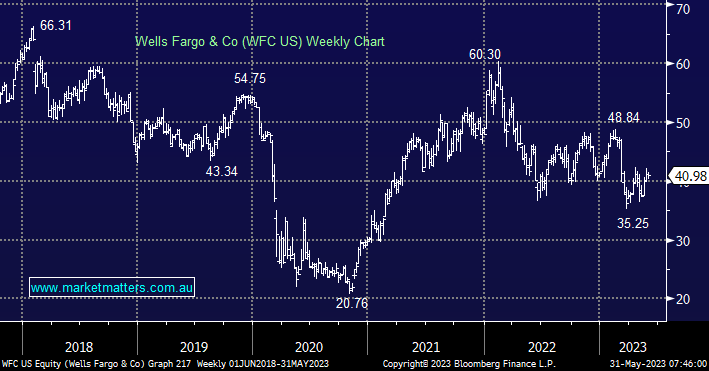

Again we’re looking at a stock weighing on our portfolio’s performance with WFC showing us an almost -16% paper loss after tumbling in sync with the US Banking Sector as the regional names came under fire due to savaged bond prices. In hindsight, we should have locked in profits but that’s now irrelevant, what matters is the plan going through the remainder of 2023/4.

WFC has been making progress with its regulatory process having made a $US1 billion dollar settlement with shareholders earlier in the month, an arduous journey that’s finally coming to an end. In our opinion, WFC can now finally focus its efforts on what it knows best i.e. banking. Interestingly even after the stock has been hammered since early 2022 the brokers like it with 14 buys and 7 strong buys from a total of 28 analysts, their consensus target price is $US48.75, a very similar level to our own target area. As we enter a cycle of higher interest rates WFC should be able to cement higher margins enabling it to rebuild confidence in the bank – last year saw Warren Buffett switch his Wells Fargo position into Citigroup after the company lost its “moral compass”.

The company has a rebuilding process to undertake but if we are correct WFC is now well positioned as recovery stock.

- We believe Wells Fargo (WFC) was unduly punished by the US Banking Crisis with a retest of the $US50 area as our preferred scenario.