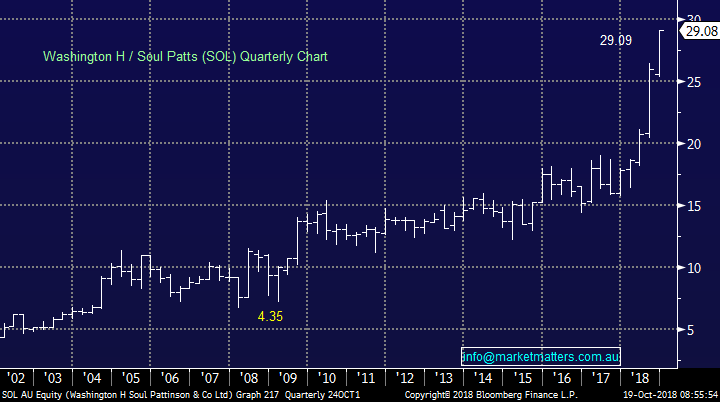

Should we chase the best performing stocks of the last 3-months? (SOL, MYX, TLS, NVT, NST)

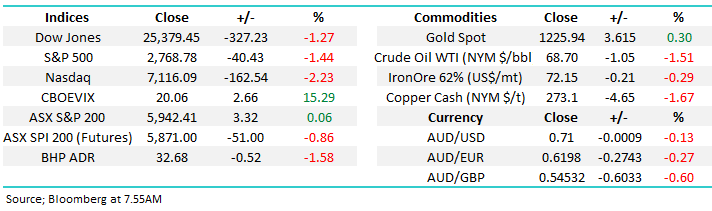

The ASX200 enjoyed a relatively solid day closing marginally in the black but importantly managing to ignore both a negative lead from Wall Street and a plunging Chinese share market. A firm banking sector helped support the local market undoubtedly assisted by the strong Australian employment data. Stocks have been striving to regain a degree of confidence but this will obviously be tested in a major way this morning.

Yesterday Chinese stocks plunged almost 3% to fresh 4-year lows as the Yuan hit fresh 2-year lows, rumours of widespread margin calls fuelled the selling, an easy scenario to comprehend with the Shanghai Composite down a huge 30% in 2018 alone. Government intervention would not surprise in the coming days / weeks if the selling momentum continues but until we see a degree of stability from the world’s second largest economy our resources sector remains vulnerable to ongoing weakness. (The US economy is worth $20.4 trillion according to the IMF while China’s economy is worth $14 trillion. In the last year, the US economy has grown by $1 trillion while China has grown by $2 trillion).

The US – China trade war is undoubtedly creating volatility and fear in global markets with China taking its turn yesterday, as we’ve said previously it feels that this macro-economic landmine is unlikely to be diffused before the US mid-terms on November 6th.

MM remains mildly negative the ASX200 targeting another test of the 5800 with US weakness we believe the likely catalyst, similar to last week.

Overseas stocks were sold aggressively overnight with the S&P500 falling -1.4%, the brunt of the selling was focused back in the high valuation IT stocks illustrated by the NASDAQ declining -2.2%. The ASX200 is poised to open down around 50-points / 1% with BHP likely to again be a weight on the index following its ~50c / 1.6% decline on the US ADR market. BHP should open at around $33.20 this morning.

Yesterday we looked at the markets worst performing stocks over the last 3-months, today we’re going to assess the cream, asking the question is it too late to jump on board?

ASX200 Chart

US stocks

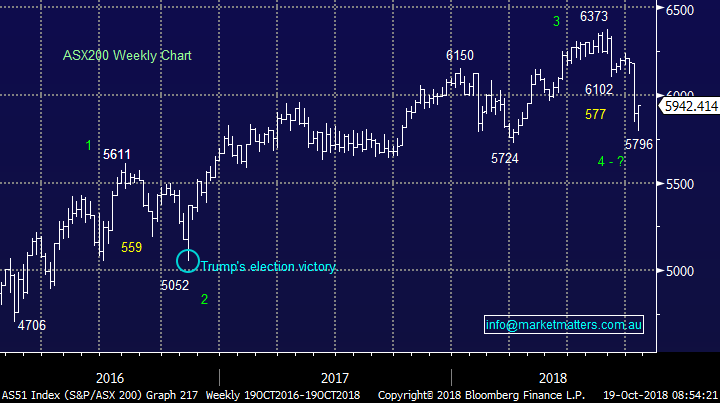

As we mentioned earlier, the US market was sold down sharply overnight as concerns around the US – China trade war, Italian debt and rising interest rates resurfaced only 48-hours after they had been apparently dismissed. The markets optimism / pessimism just like that of the stock / sectors is changing almost daily.

US stocks are following our preferred path so when “it’s not broken, don’t fix it!”. We remain short the US market via the BBUS.

MM remains bearish US stocks targeting another 5-6% decline by the broad Russell 3000.

Russell 3000 Index Chart

When markets suffer sharp falls, it can often be an opportune time to buy the best performing stocks who generally are dragged lower if only by futures selling / arbitrage.

Surprisingly in a weak period where the index fell 5% the 5 best performers of the last 3-months, basically offset the 5-worst performers, an impressive effort.

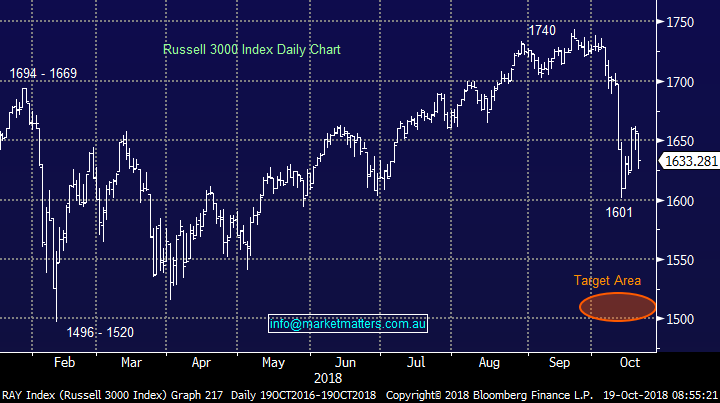

1 Washington Soul Pattinson (SOL) $29.08

SOL is a fascinating business spread across many different areas including financial services, telco, real estate and equities. Managing a return of +39.8% over the last 3-months is pretty amazing at first glance considering the company’s diversification.

However, SOL’s largest holding is TPG Telecom which has rallied 55% this financial year – that will do it! Two other large holdings are Brickworks (BKW) and New Hope (NHC) both of whom have soared in recent times.

Basically, SOL is trading like an extremely concentrated fund manager who has got it very right in 2018.

Unfortunately, this is one horse that looks like its bolted from a risk / reward basis.

MM likes SOL but it needs a $3-4 pullback to be worth considering and ultimately, its performance will be a pass through of the companies it holds.

Washington Soul Pattinson (SOL) Chart

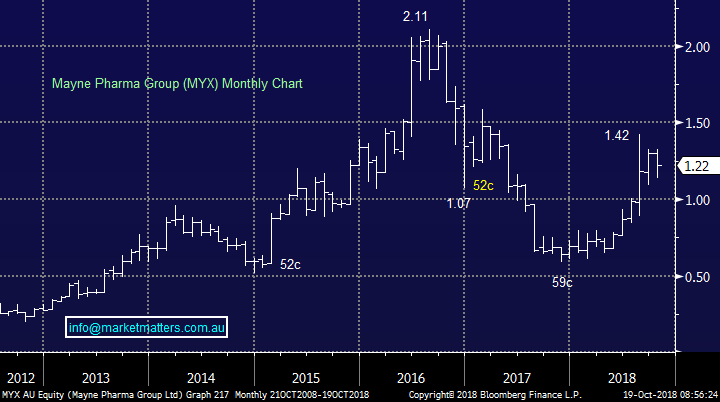

2 Mayne Pharma Group (MYX) $1.22

Mayne Pharma (MYX) is up +39.7% over the last 3-months but it remains down almost 50% from its 2016 high. However, the business looks to have turned the corner over the last 12-months with net income above $40m and debt subsequently reduced to more manageable levels.

MYX is a pharmaceutical company with global exposure through distribution in North America, Europe, Asia plus of course Australia and while it’s not cheap from a valuation perspective it does look to have good momentum

The stock is extremely volatile but we like it as a speculative buy ~$1.10.

Mayne Pharma Group (MYX) Chart

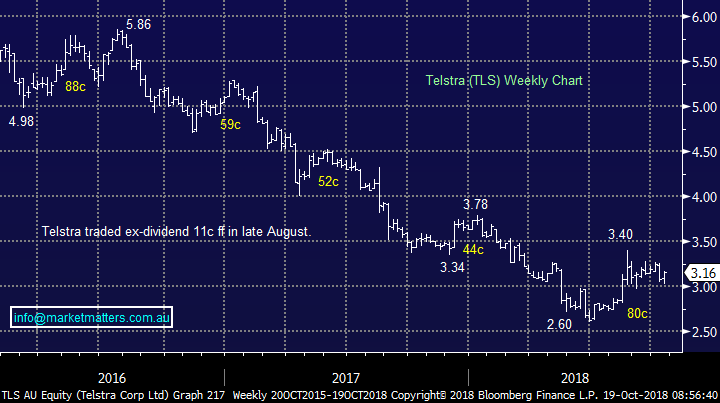

3 The Telco’s- sector is up +11.6%

The whole sector has taken off since the announced merger between TPG Telecom and Vodafone back in August, over the last 3-months Vocus (VOC) is up +38.1%, TPG Telecom (TPM) +38.5% and Telstra (TLS).

No major change here, at today’s prices Telstra is our favourite out of the recently dynamic trio.

We are bullish TLS around todays levels with an initial target 10% higher.

N.B. we hold 7% of the Growth Portfolio in TLS at present and 5% in the Income Portfolio

Telstra (TLS) Chart

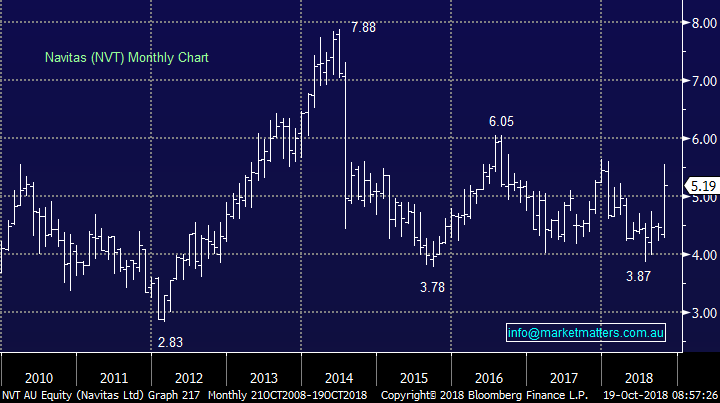

4 Navitas (NVT) Ltd $5.19

NVT is up +25.4% over the last 3-months with most of the advance unfolding last week after the education provider revealed a bid from BGH / Australian Super – the previous suitors for Healthscope (HSO).

Our “Gut Feel” is the risk / reward from holding on anywhere near the $5.50 bid price is unattractive. The bidders have already shown their readiness to walk away from a deal without increasing the offer price with HSO.

If we were holders we would be selling and looking elsewhere especially as the market is going through a correction.

Navitas Ltd (NVT) Chart

5 Northern Star Resources (NST) $8.77

NST is up +22.2% over the last 3-months having jumped ~15% back in early September following the company raising $175m to part fund the purchase of a mine in Alaska.

This business has performed admirably over the last 2-years while others in the sector have huffed & puffed at best e.g. Regis Resources (RRL) is down almost 25% since its July high.

Our concern is NST has become the ‘go to’ stock in the sector leading to potential lack of sellers in the months / quarters ahead.

We remain bullish NST technically but fundamentally the stocks screens ‘expensive’ at today’s levels / relative to peers

Northern Star Resources (NST) Chart

Conclusion

Of the 5 stocks / sectors covered today we can split them into 3 simple groups:

1 Buy – Telstra (TLS).

2 Buy at lower prices – Sol Patts. (SOL), Mayne Pharma (MYX) and Northern Star (NST).

3 Sell into any strength – Navitas (NVT).

Overnight Market Matters Wrap

· The US equity markets resumed its current downtrend, with the tech. heavy Nasdaq 100 hit the hardest, off 2.23% as risk was certainly off investor’s table.

· The selloff was seen globally as the European commission issued its concerns on Italy’s budget as well as the current tension between Saudi Arabia and the US.

· BHP is expected to underperform the broader market, after ending its US session down an equivalent of 1.58% following the slide in crude oil overnight.

· The December SPI Futures is indicating the ASX 200 to follow the US path and open 54 points lower, testing the 5890 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 19/10/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.