What Matters Today in Markets: Listen Here each morning

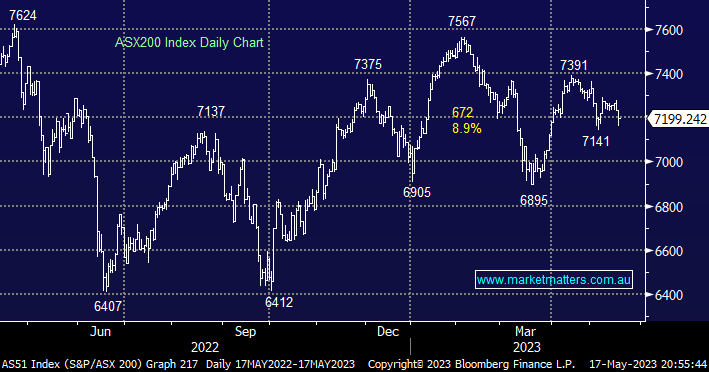

The ASX200 fell over -1% early on Wednesday following a poor lead from overseas bourses and negative sentiment after the RBA’s hawkish minutes from the latest meeting. Some buying did emerge through the morning as US futures bounced but the index still closed down -0.5% as the number of losers more than doubled the number of winners. On the sector front the story remains the same as increasing recession fears and a firm $US weighed on the miners while interest rate sensitive names fared far better:

Winners: Xero (XRO) +1.9%, REA Group (REA) +1.3%, Altium (ALU) +1%, and Wisetech Global (WTC) +1%.

Losers: Sandfire Resources (SFR) -4.9%, Evolution Mining (EVN) -2.3%, South32(S32) -1.5%, and Iluka (ILU) -1.2%.

While we believe this trend has further to play out the elastic band is stretching ever further e.g. Sandfire Resources (SFR) has corrected -18.6% from its April high while Xero (XRO) has made fresh 9-month highs this month. The latest Bank of America (BofA) Fund Mangers Survey told a similar tale illustrating investors have flocked to cash amid concerns that a recession/credit crunch are looming on the horizon:

- US fund managers are now at their most bearish for 2023 with 65% now expecting the US economy to deteriorate further although a soft landing remains the pick of most experts.

- Cash levels rose to 5.6% while the migration to the IT Sector which enjoyed its largest 2-month increase since the GFC placing long “Big Tech” as the clear most crowded trade.

- The rotation out of the resources into tech was highest since December 2021, we are looking to fade this move as the crowd builds in one corner.

- Investors have now positioned themselves the most long ‘growth’ over ‘value’ since July 2020, almost 3-years ago.

MM has been fairly quiet of late only tweaking a few portfolios around the edges but in the next 1-2 quarters we envisage ourselves migrating back up the risk curve through increasing overall market exposure while also switching our overweight Tech weighting back to the resources. The Australian IT Sector is less than 4% of the ASX200, although it often feels like more from a sentiment perspective, our Flagship Growth Portfolio holds well over 10% in Tech both directly and indirectly.

Following a strong session on Wall Street the SPI Futures are calling the ASX200 to recover all of yesterday’s losses with a +60c advance by BHP in the US set to support the index. The gains in the US we’re fuelled by easing default concerns which enabled the NASDAQ to make fresh highs for 2023 on increasing risk appetite but overall gains were broad-based suggesting we should see the same this morning on the ASX.

- No change, we are sticking to our “buy weakness and sell strength” mantra for 2023 as sector/stock rotation continues to dominate the market.

This morning we’ve quickly updated our view on 3 stocks that caught our attention under the hood on Thursday as we start to prepare for what comes next if the $US reaches our 105-106 area and recession fears continue to grow.

- Remember stocks usually lead commodities hence when stocks hold/rally while commodities continue to fall we will regard it as a “Buy Trigger”.