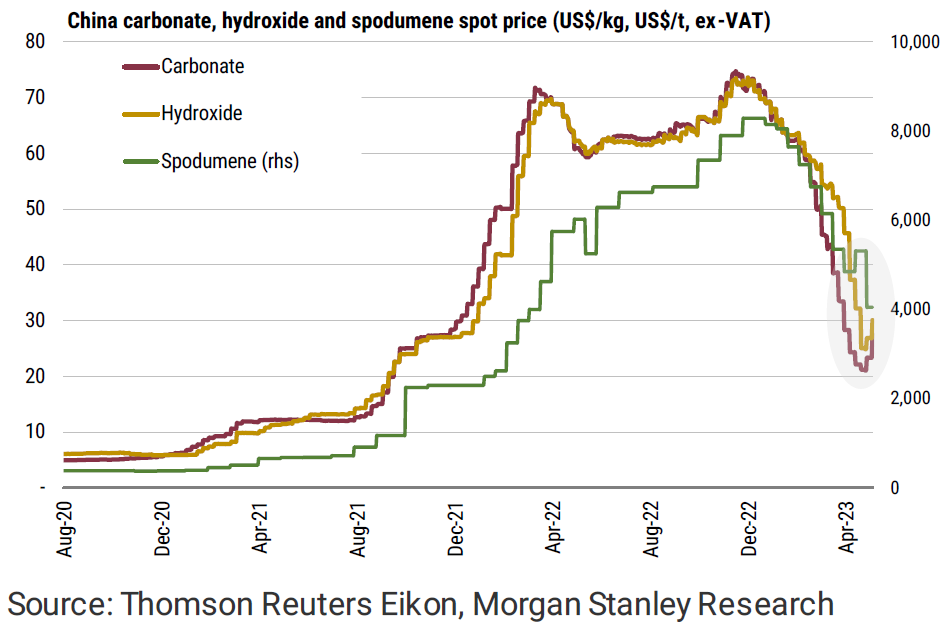

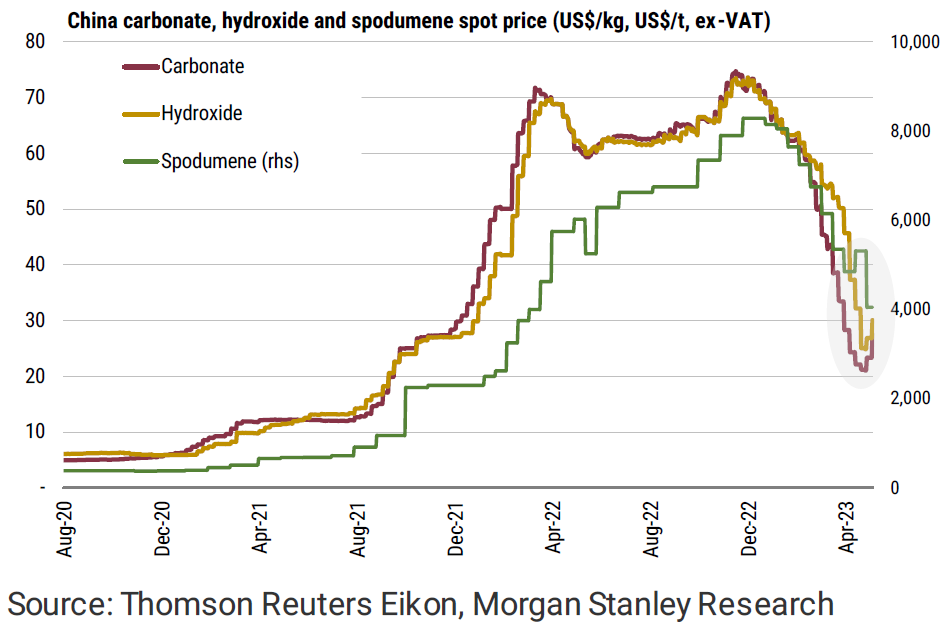

There has been phenomenal hype in recent years around Lithium and other key commodities that underpin the global move towards Electric Vehicles (EVs), and we think there is a solid foundation to this sector, however, the shorter-term movements in the Lithium price for example, where a pullback of ~70% has recently played out, highlights a theme that MM often speaks of, around crowded trades creating risk.

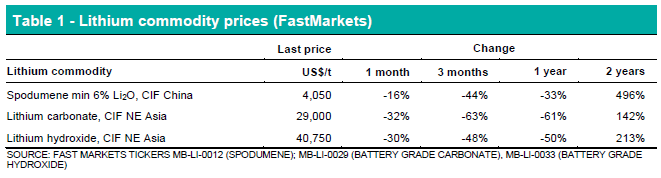

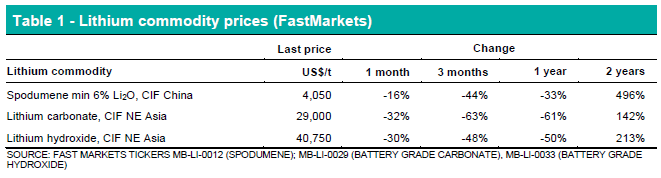

This table courtesy of Bell Potter provides some context around Lithium pricing over various time frames.

NB: Spodumene is the hard rock that lithium resides in. To extract Lithium from Spodumene, it gets crushed, roasted, ground further then goes through a process of acid leaching.

Lithium-ion batteries are not new, they’ve been powering laptops, mobile phone batteries, and even off-grid camping setups for some time, however, it’s the growth in electric vehicles that is driving the demand for this lightweight, high-energy-density input. China is the largest and fastest-growing EV market in the world, however, the growth is slowing. The market more than doubled in 2021 & 2022 while this year it is expected to grow by around 30% – still very solid numbers in a huge market where 25% of all new vehicles sold are EVs. Slower demand this year caused a big decline in prices of raw materials and the stocks that mine them.

In a recent update, Pilbara Minerals (PLS) said they anticipate further price weakness for another month or so, before a potential strengthening in the second half of 2023 as China restocks inventory levels. This has been a view shared by most Lithium producers while Morgan Stanley wrote in a note yesterday that prices have now turned up after a significant sell-off as inventories are now lower and supply growth has disappointed. They think that the price has bottomed, for now at least, and some respite through the sector is warranted.

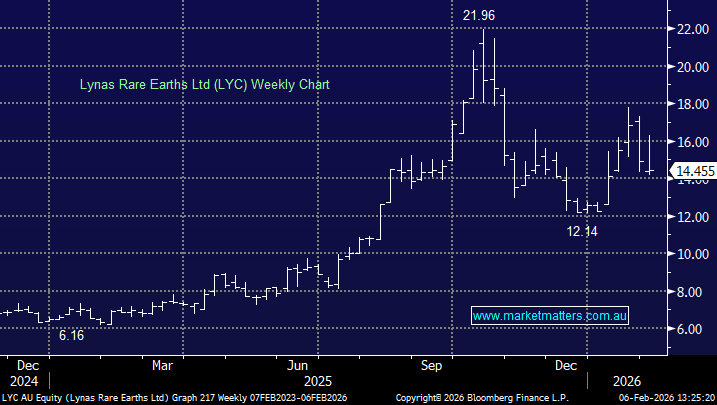

The key takeaway for MM is that commodities are cyclical, and high prices incentivise new production that ultimately solves those high prices. While we cannot see Lithium prices re-scaling the 2022 highs for many years, there is still plenty of opportunity.

- Following a sharp correction, MM believes the risk/reward in Lithium & other related commodities has improved.