What Matters Today in Markets: Listen Here each morning

*Have a great Easter, please note our next morning report will be on Tuesday the 11th of April*

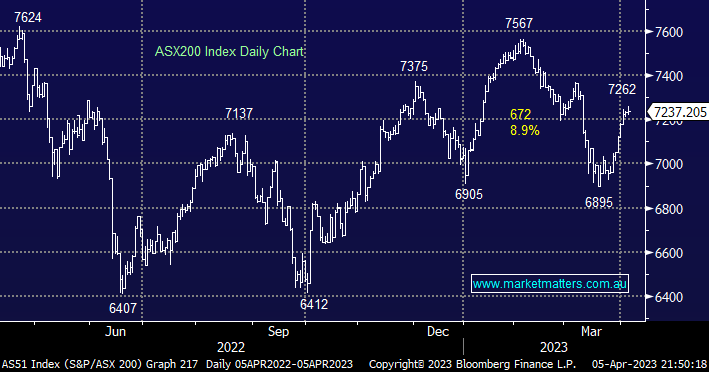

The ASX200 posted fresh 4-week highs on Wednesday although the market did surrender almost all of its early gains after Philip Lowe (RBA) threatened more interest rate hikes further down the track but overall we believe short term traders are simply squaring off as we head into the Easter period – remember the very important US Employment data comes out on Friday when the local market is closed making it an easy decision for short term traders to reduce risk. On Wednesday we saw winners beat losers with over 55% of the main board closing higher as healthcare, industrial and tech stocks caught our eye while the resources continued to limit market gains e.g. South32 (S32) -2.1%, BHP Group (BHP) -1.5%, IGO Ltd (IGO) -1.1% and Woodside (WDS) -0.6%.

- We continue to believe the RBA will hold the Official Cash Rate at 3.6% through 2023.

The “Big 4” banks already appear to have closed up shop for the Easter holiday with all of them closing up or down by just 0.1%, however as volumes start to fall the ongoing lack of selling remained apparent in the gold miners and IT stocks with a few standouts highlighted below, all of which have enjoyed a solid start to April:

- Golds – Regis Resources (RRL) +6.4%, Evolution Mining (EVN) +4%, and Newcrest Mining +3.1%.

- Tech – REA Group (REA) +1.4% and Xero (XRO) +1.2%, and Wisetech (WTC)M +0.5%.

We believe the Growth stocks will continue to outperforms Value through early/mid-April but we are conscious that the elastic band is stretching and we are monitoring our overweight stance looking for optimum opportunities to tweak exposure in our Flagship Growth Portfolio back towards the miners.

US stocks experienced a mixed session overnight with the Dow rallying while profit taking into Easter was evident in the tech stocks which slipped -1%, the SPI Futures are calling the local market to close down less than 0.1% as plans for the Easter break dominate conversations across the trading desks.

- As we head into Easter we’re looking for a period of consolidation by local stocks after their strong advance over recent weeks.