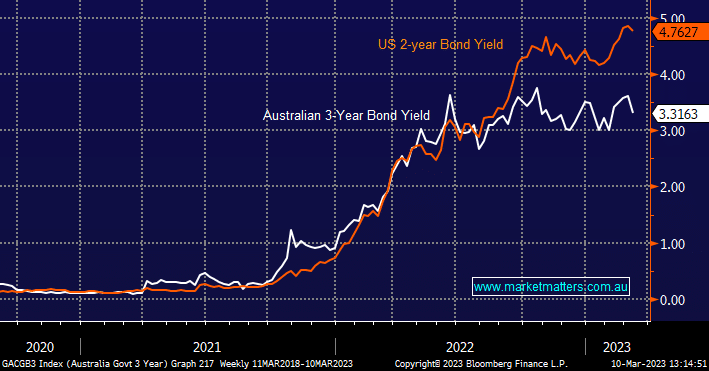

What are the implications of “MM believes that the differential in cash rates between Australia & the US can reach 2%.”

Hi James and Team I found the graph re US/Aus cash rates on Thursday morning's report very interesting and wondered whether you could expand on the implications of a widening gap in the US/Aus cash rates ..specifically does this imply that Australian firms that earn mostly in USD are set to outperform ? if so I'm thinking CSL but what others may do well .. Also wondering whether you could give some further discussion to those taking a risk off approach..how is the outlook at present for hiding in hybrids or bonds looking ? .. Many Thanks