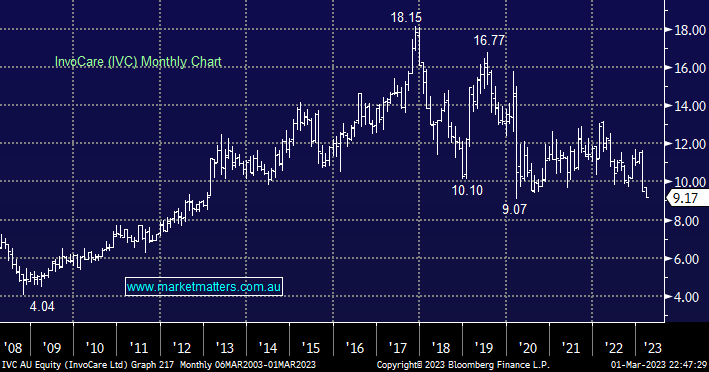

This funeral homes operator has already fallen -13.9% this year yet the death rate last year was abnormally high. The company has had issues with staff and overall cost inflation which accelerated in 2H22 resulting in a ~17% EBIT miss when it reported in February, when combined with a business still losing market share albeit it at an arrested rate we see no reason to become excited about IVC especially when the death rate migrates back to a more normal level.

- We believe IVC is simply too expensive trading on a 27.4x valuation for 2023 as its business continues to contract.