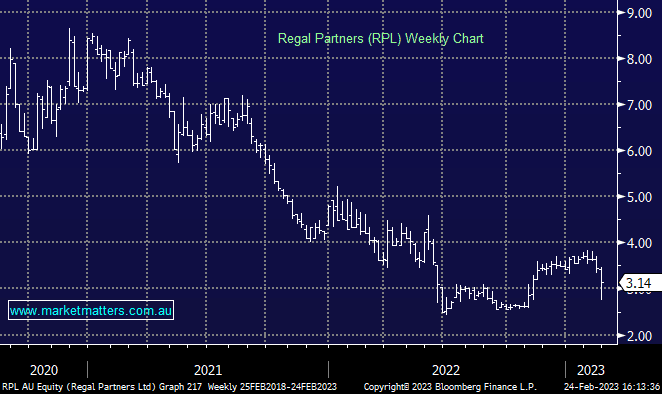

RPL -1.26%: full-year results for the fund manager today, shares closed slightly lower on a volatile session. The numbers were solid, if not a little messy given the acquisition of VGI Partners in the middle of the year. FUM ticked higher, seeing $0.7b of net inflows, partly offset by $0.2b of negative performance in the second half. They still managed to gain $14.5m in performance fees despite difficult market conditions, positive 2H NPAT of $18.2m. The balance sheet is in great shape, even after the acquisition of East Point which they picked up earlier this month. Regal are doing a good job of growing organically and through M&A, we expect to see further consolidation in the space which will benefit RPL.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Gerrish: The correction is done, we’re positioning for what comes next

Gerrish: The correction is done, we’re positioning for what comes next

Close

Close

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Close

Close

Friday 9th May – Dow up +254pts, SPI up +3pts

Friday 9th May – Dow up +254pts, SPI up +3pts

Close

Close

MM is bullish and long RPL in the Emerging Companies Portfolio

Add To Hit List

In these Portfolios

Related Q&A

Regal Partners (RPL) and Smart Group (SIQ)

Dividend Trap?

Fund Managers

Does MM now like Regal Partners (RPL)

Is Regal Partners Limited (RPL) worth a punt?

Queries on FSLR, FTCH (US) and CLX, RPL (ASX)

Can MM please clarify your thoughts on Regal Partners (RPL)?

Thoughts on RPL & MAAT please

Relevant suggested news and content from the site

Video

WATCH

Gerrish: The correction is done, we’re positioning for what comes next

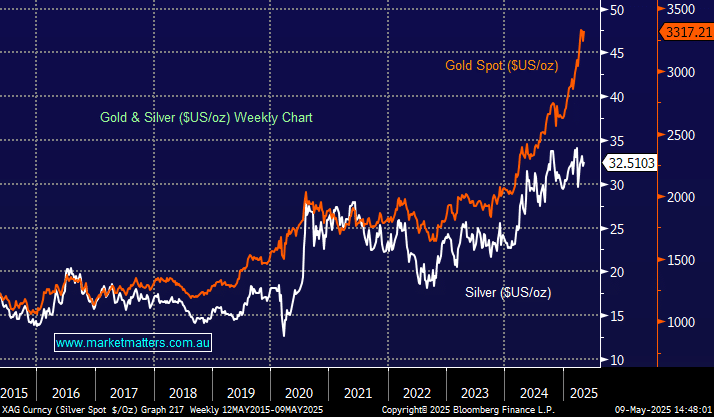

The Market Matters lead portfolio manager talks the recent recovery, Trump, gold, and why he thinks there's plenty of opportunities.

Video

WATCH

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Recorded Monday 31st March

Podcast

LISTEN

Friday 9th May – Dow up +254pts, SPI up +3pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.