Logistic software giant WTC continues to invest heavily in R&D ($755mn in 5 years) and the result is a great product with compelling pricing power. The markets embraced its latest result which saw revenue grow 35% to $378.2mn, our only concern is that after 43 acquisitions in 6 years, it’s going to become incrementally harder to lift the impact of future purchases making its 81x valuation for 2023 a touch daunting.

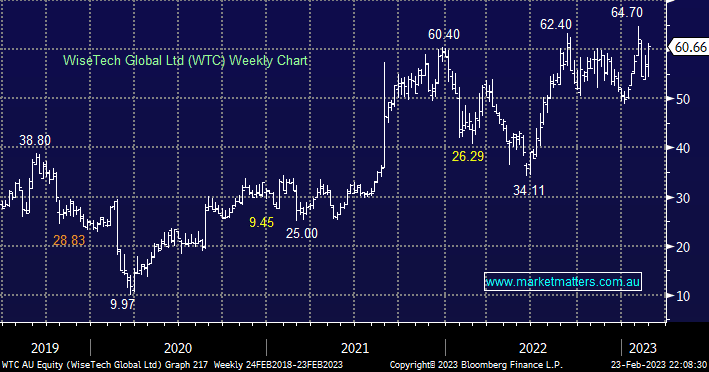

- We like WTC around $60 short term but are reticent to chase into fresh highs.