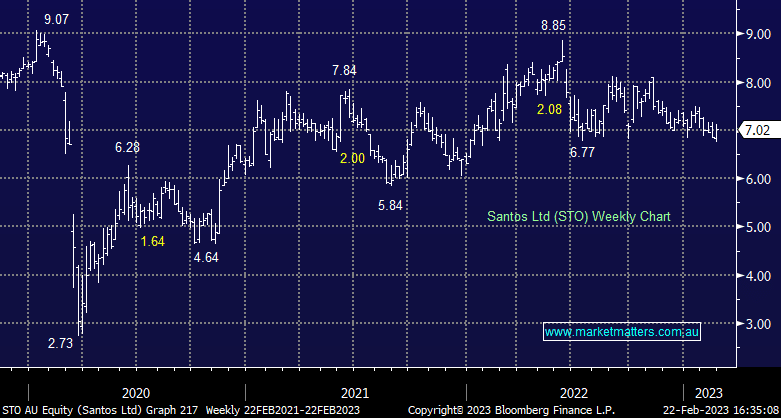

STO +3.08%: Had a good session today following FY22 results that showed NPAT of US$2,46bn, up 160% on CY21 due to higher oil and gas prices. While 2H earnings were weaker than forecast due to higher costs, the dividend of 15.1c was better and their guidance was good. STO is still a low cost business with a $34/bbl free cash flow break-even oil price. They have underperformed Woodside (WDS) all year and we think STO now represents an opportunity as a relative value play.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Gerrish: The correction is done, we’re positioning for what comes next

Gerrish: The correction is done, we’re positioning for what comes next

Close

Close

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Close

Close

Friday 9th May – Dow up +254pts, SPI up +3pts

Friday 9th May – Dow up +254pts, SPI up +3pts

Close

Close

MM is turning more bullish on STO ~$7, particularly from a relative standpoint

Add To Hit List

Related Q&A

Energy Stocks: WDS, STO & BPT

Thoughts on the local energy stocks as crude continues to climb higher?

Why MM has reduced our energy exposure

Where to for crude oil?

What to buy with spare cash?

Relevant suggested news and content from the site

Video

WATCH

Gerrish: The correction is done, we’re positioning for what comes next

The Market Matters lead portfolio manager talks the recent recovery, Trump, gold, and why he thinks there's plenty of opportunities.

Video

WATCH

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Recorded Monday 31st March

Podcast

LISTEN

Friday 9th May – Dow up +254pts, SPI up +3pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.