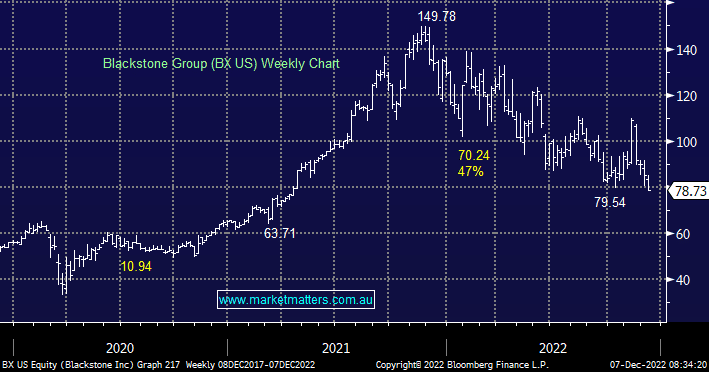

The weakest link on our published list is down nearly 14% since we flagged the leading alternative asset manager as a ‘stock to buy here and now’. Since the call, a few things have happened to pressure the stock, the most notable of which was limiting withdrawals from their $100bn real-estate fund. They have a cap here (2% of net asset value monthly & 5% quarterly) that was exceeded so they don’t let investors redeem their funds. 2 key points here. As the owner of the equity, we think Blackstone is very well placed to take advantage of the markets over the coming years – dislocation is good for big managers that can move quickly and Blackstone is that 2. This should serve as a reminder for those who are invested 100% through funds, liquidity can be an issue and is dictated by the underlying assets held + the whim of the manager who can close the doors. It’s also a reminder that investing in unlisted assets as many are now doing (growth area) will result in lower liquidity. MM is all about holding direct assets where we can, and news like this underpins our reason for doing so.

The investment thesis has not changed, and we remain positive on Blackstone (BX US) despite recent weakness.