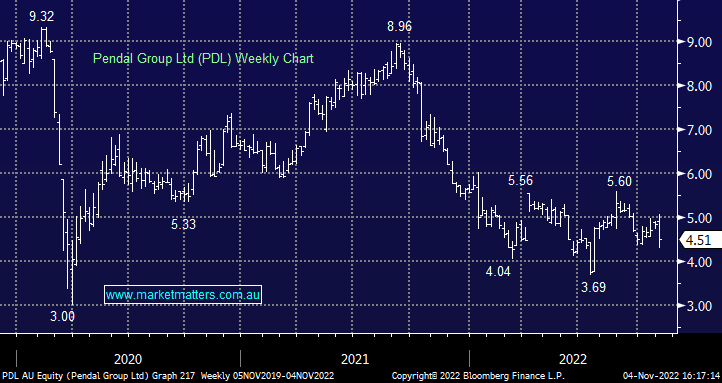

PDL -0.22%: Putting the three way takeover tussle to one side, Pendal (PDL) reported full year results this morning that were solid, all key metrics were in line to slightly above market expectations with revenue of up 8% to $629.7m and underlying profit up 17%. The dividend of 3.5cps for the half was below 22cps expected however the dividend comes off the cash component of the Perpetual bid so it’s net net neutral, as we suspect they would pay the difference out if the deal falls over. On the earnings call this morning, Pendal CEO Nick Good was stressed multiple times that the deal with Perpetual was a “legally binding contract”, that he didn’t anticipate any problems with the Pendal shareholder vote and both teams were “moving forward with the path laid out”.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

Monthly Update: Portfolio performance and positioning during October

Monthly Update: Portfolio performance and positioning during October

Close

Close

We own PDL in the Income Portfolio

Add To Hit List

Related Q&A

Thoughts on PPL’s takeover of PDL?

Why is Pendal (PDL) falling after PPT’s bid?

Is MM still happy with its PDL recommendation?

Clarifying MM thoughts on Pendal (PDL)

MM views on PDL

Relevant suggested news and content from the site

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Recorded Thursday 20th November

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Video

WATCH

Monthly Update: Portfolio performance and positioning during October

Recorded Thursday 6th November

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.