Most people have started to feel the pinch of rising interest rates combined with the general cost of living but as we all know people need to eat and shop at supermarkets, they are not destinations of discretionary spending except for the quality/cost of individual items chosen – more expensive options generally have higher margins. Operationally these same supermarkets have needed to carry the burden of rising heating, cooling, and probably most painful of all wages, with all of these factors weighing on margins.

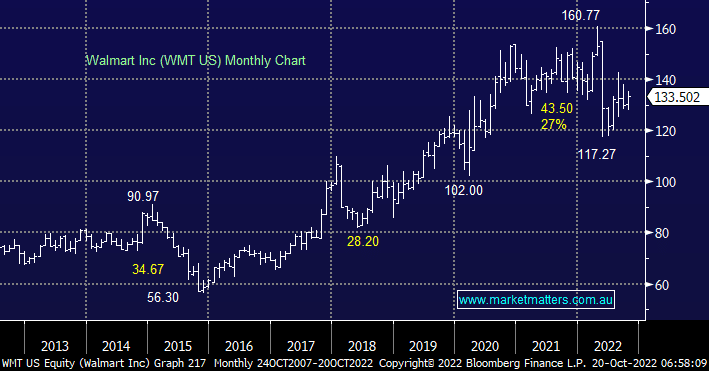

The world’s largest retailer Walmart (WMT US) saw its stock plunge in May after profitability declined due to margin contraction as supply chain issues and higher labour costs delivered a double whammy to shareholders. The hit to the company’s bottom line was far worse than expected and the stock was re-rated almost instantly, now 5-months later the landscape has evolved further, and supply chain issues are slowly easing but wage pressures remain, moving forward how similar businesses deal with inflation looks set to determine their performance over the coming few years.

In the last quarter Walmart (WMT US) delivered better-than-expected earnings after two previous profit warnings, certainly not conclusive but a step in the right direction.

- We believe Walmart (WMT US) looks ok around $US135 with better value on offer following the stock’s fall in 2022.