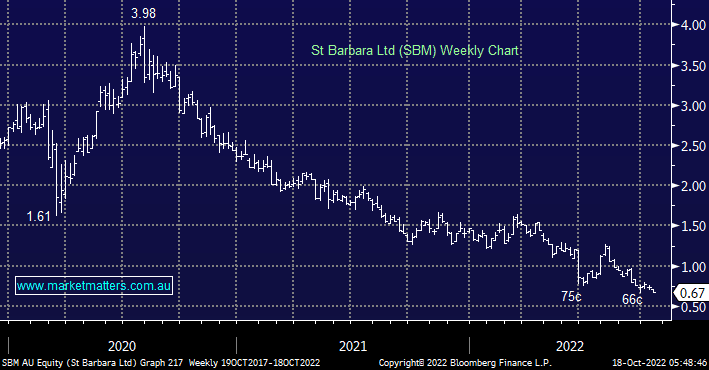

SBM led the Gold Sectors descent yesterday tumbling another 8% and registering multi-year lows in the process – until the $US and bond yields pull back it’s hard to see precious metals coming back into favour. MM is looking for these inflection points to unfold this quarter but it’s hard to quantify the risk/reward towards stocks like SBM which continue to struggle – it’s simply a very disliked trade at the moment and an example where stocks & sectors can remain ‘cheap’ for extended periods. SBM delivers their 1Q production numbers today, FY production & cost guidance key and whether or not these have been impacted by labour issues.

- We believe the gold stocks are close to a 2022 low but we see no reason to increase our exposure (yet).