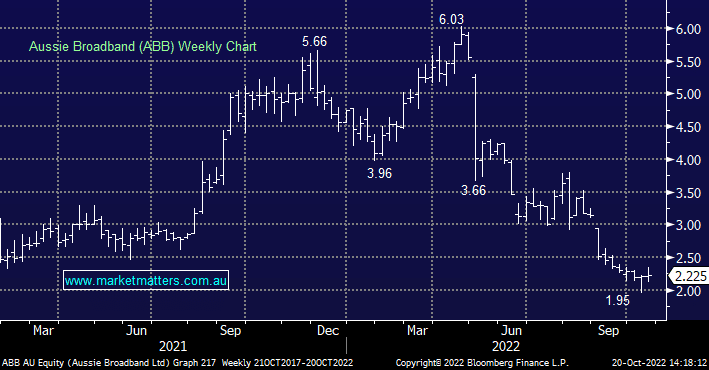

Does MM like ABB after recent weakness?

Can we please have an update on ABB. It bounced hard today (finally), but has otherwise been in free-fall to a perhaps surprising extent, closing at $1.95 a couple of days ago. I recall directors buying and MM liking it at considerably higher levels not too long ago. What are your views on the price action/extent of the fall in share price? Also, is ABB a stock that MM, if it did not already have a position, would have become even more keen on accumulating as the price fell to recent levels? Has MM in fact considered averaging down? Thanks Darren