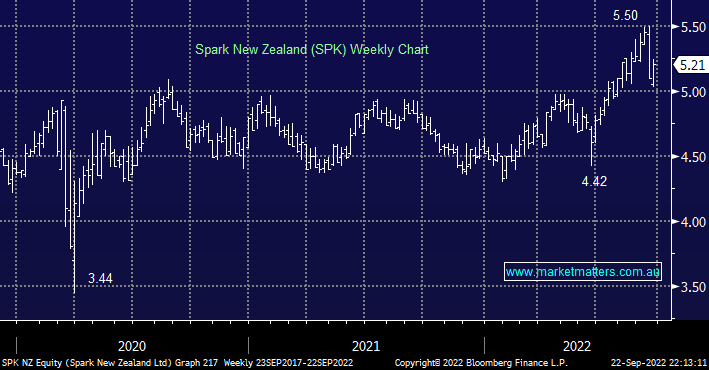

SPK which is formerly Telecom Corp. of NZ has been the standout sector performer over recent years but it’s not particularly cheap above $5 however the trends friend especially in a market as nervous as today i.e. SPK is performing strongly and is in a relatively recession-proof industry. We like SPK on its improving outlook for mobile revenue and prospect of higher dividend growth – they recently reported a strong FY22 EBITDA of $1.150bn which was in line with guidance.

- We like this telco with its estimated 5.6% yield over the next 12-months making the stock very attractive for the income hungry moving forward, especially into any dips.