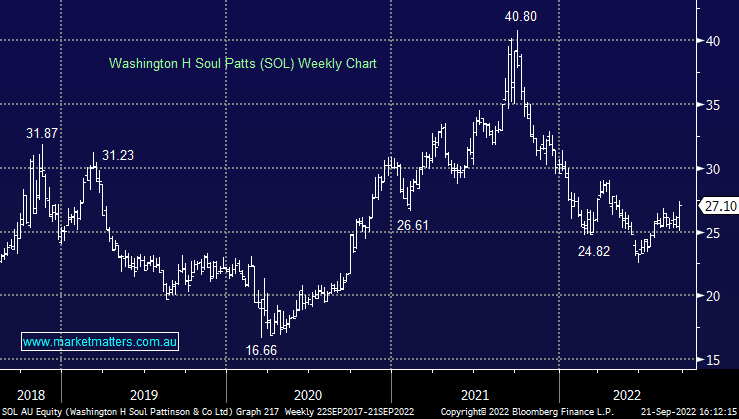

SOL +4.96%: the investment company rallied to a 5-month high today on the back of strong performance in underlying investments. The company now runs nearly $10b across equities, property and private equity with a strong NAV per share increase of 13.8% in a market that fell. The total value of the portfolio increased by 72% largely on the back of their merger with Milton. They finished the year in a net cash position, providing investment flexibility in the volatile market. Their investment in New Hope Coal (NHC), of which they own nearly 40% of the shares on issue, was a major contributor to an increased dividend for the full year. They’ll pay a 43c final dividend along with a 15c special. The company said the market remains volatile, however, they are confident in continued outperformance with a focus on sustainable, cash-generating businesses that they expect to remain resilient.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

Monthly Update: Portfolio performance and positioning during October

Monthly Update: Portfolio performance and positioning during October

Close

Close

MM is bullish SOL

Add To Hit List

Related Q&A

Thoughts on these 3 stocks.

Washington Soul Patts (SOL)

Washington Soul Patts (SOL) and Brickworks (BKW) Merger

Washington H Soul Patts (SOL)

AMA Group Ltd (AMA)

What Building stocks does MM like today?

Does MM like BKW or SOL?

Does MM like SOL &/or BKW?

MM’s thoughts on SOL , BKW and JLG please!

SOL-MLT Merger

Relevant suggested news and content from the site

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Recorded Thursday 20th November

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Video

WATCH

Monthly Update: Portfolio performance and positioning during October

Recorded Thursday 6th November

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.