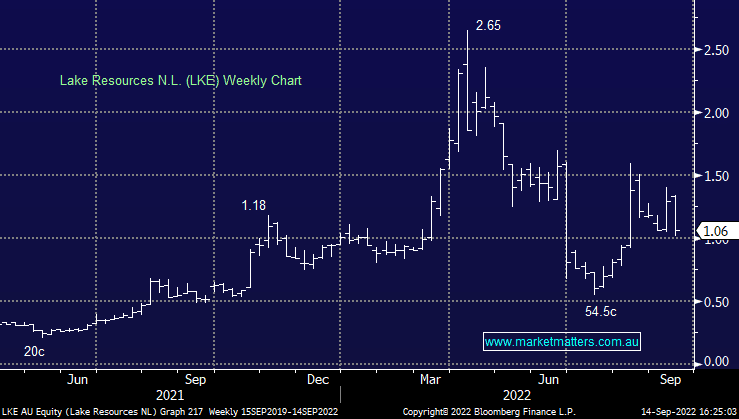

LKE -16.54%: the lithium hopeful tumbled today after getting caught in a tussle with the operations company they’ve employed at their Kachi site following a disagreement about milestone cut-offs. Lilac will earn a stake of up to 25% of the project if they complete 1,000 hours of operations and 2,500kg of lithium carbonate. Lake believes these milestones need to be met by 30 September, while Lilac believes they have until the end of November with the dispute now going to mediation. While Lake has been well-bid thanks to a strong rally in lithium stocks, it’s had ongoing issues with delays to studies and turnover in key management positions as well as an attack from short sellers earlier in the year. Clearly, a few things bubbling away under the surface.

scroll

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

Monthly Update: Portfolio performance and positioning during October

Monthly Update: Portfolio performance and positioning during October

Close

Close

MM prefers PLS in the lithium space

Add To Hit List

Relevant suggested news and content from the site

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Recorded Thursday 20th November

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Video

WATCH

Monthly Update: Portfolio performance and positioning during October

Recorded Thursday 6th November

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.