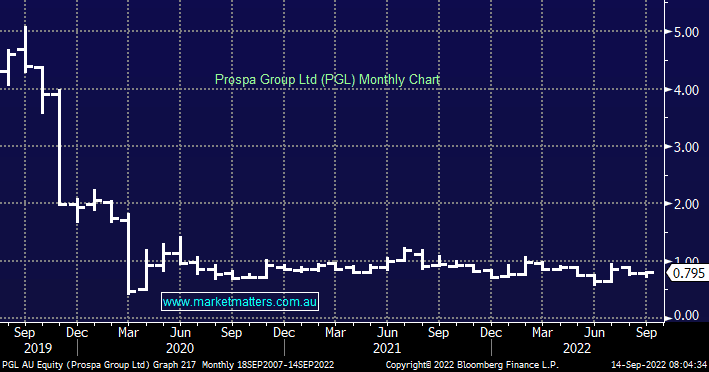

Prospa Group is a small & medium enterprise (SME) lender, specializing in loans up to $500k to customers in Australia & New Zealand. It’s small with a market capitalization of $130m, however, it recently posted a strong FY22 result with EBITDA more than doubling, and positive earnings. In the last quarter, they wrote a record $245.7m in loans, taking the total loan book to over $700m. Funding costs have been coming down despite rising interest rates, falling from 6.7% in FY20 to 5% in FY22. Metrics point to an outstanding business with strong repeat customers and a brand that is ticking boxes in terms of customer satisfaction. The issue will be if SME’s are heavily impacted by a slowing economy, and so-called zombie companies have a negative influence on PGL’s bad debts. While we like the business, we think it’s prudent to wait and see how their underlying credit quality holds up for a longer period of time before considering buying Prospa.

scroll

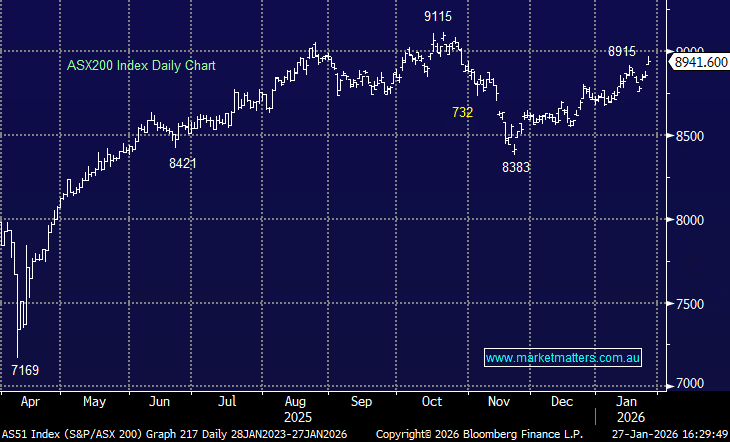

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

Monthly Update: Portfolio performance and positioning during October

Monthly Update: Portfolio performance and positioning during October

Close

Close

MM is bullish PGL, but has a few concerns around credit quality

Add To Hit List

Relevant suggested news and content from the site

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Recorded Thursday 20th November

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Video

WATCH

Monthly Update: Portfolio performance and positioning during October

Recorded Thursday 6th November

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.