How does ASX200 Quarterly rebalance impact stocks?

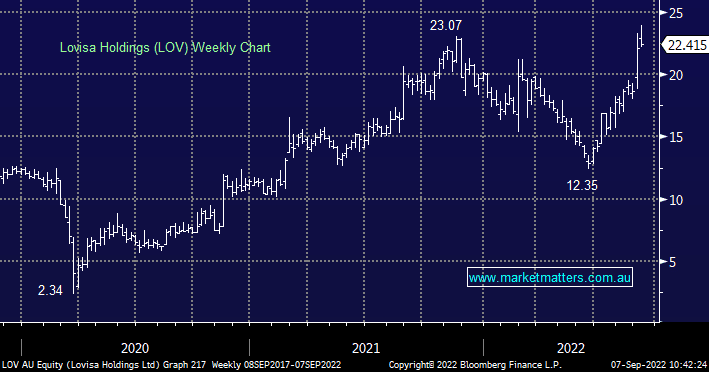

Just how much affect does the Rebalance have on the effected companies shares? For example Lovisa (LOV), going up because they are entering the ASX200? Or being pushed up by people looking to sell to big funds once added. You have said previously there are fund managers that can only deal in asx200 companies. Hence those shares leaving the ASX200 get dumped and incoming are bought, but can they buy them before officially added to the list?