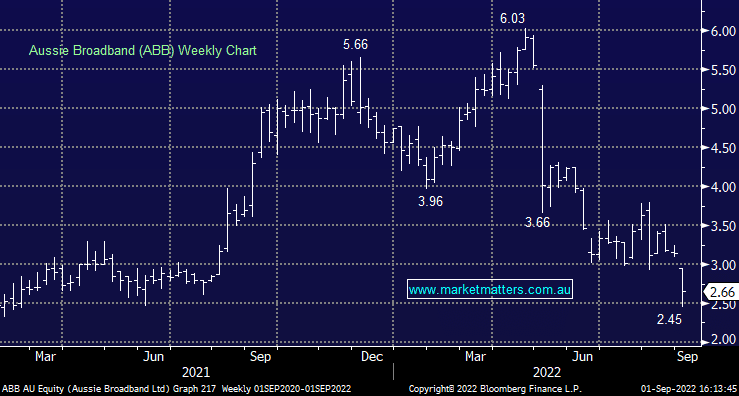

ABB -4.32%: It has been a tough period for ABB with a number of earnings downgrades sending the stock down 41% year to date. Following this week’s results and share price decline, it is worth highlighting that all of ABB’s directors have bought stock in the market since, with 6x change of interest notices out so far. Total Director buying in the last 2x business days now represents ~$1.4m. Some of the most aggressive director buying we have seen and a very good sign.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Gerrish: The correction is done, we’re positioning for what comes next

Gerrish: The correction is done, we’re positioning for what comes next

Close

Close

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Close

Close

Friday 9th May – Dow up +254pts, SPI up +3pts

Friday 9th May – Dow up +254pts, SPI up +3pts

Close

Close

MM remains positive on ABB

Add To Hit List

In these Portfolios

Related Q&A

Queries on ABB and NIC

Is Aussie Broadband (ABB) oversold?

Thoughts on ABB after its contract loss

Update of MM’s Webinar – “Pulse check 7 Highest conviction calls”

MM updates on DXS, NSR and ABB

Updates on ABB and PEN please.

Does MM still like Coal & ABB?

Does MM like ABB after recent weakness?

Is it too late to buy into ABB and DBA?

Do we prefer AD8 or ABB more?

Does MM still like Whispir (WSP)?

Should I take profit on Aussie Broadband (ABB)?

Buying ABB & PYG?

Relevant suggested news and content from the site

Video

WATCH

Gerrish: The correction is done, we’re positioning for what comes next

The Market Matters lead portfolio manager talks the recent recovery, Trump, gold, and why he thinks there's plenty of opportunities.

Video

WATCH

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Recorded Monday 31st March

Podcast

LISTEN

Friday 9th May – Dow up +254pts, SPI up +3pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.