It’s not often that MM talks about Bitcoin although we do get asked about the crypto on a regular basis, Shawn even briefly discussed it on Ausbiz yesterday. From a pure quality valuation perspective, we prefer the NDQ to increase risk exposure into ongoing weakness but if Bitcoin does again plunge lower we can see the possibility of an elastic band snap back if indeed the crypto falls too far too fast but I stress we will be adopting an if in doubt keep out attitude.

- We are considering taking exposure to Bitcoin into another aggressive panic washout on the downside.

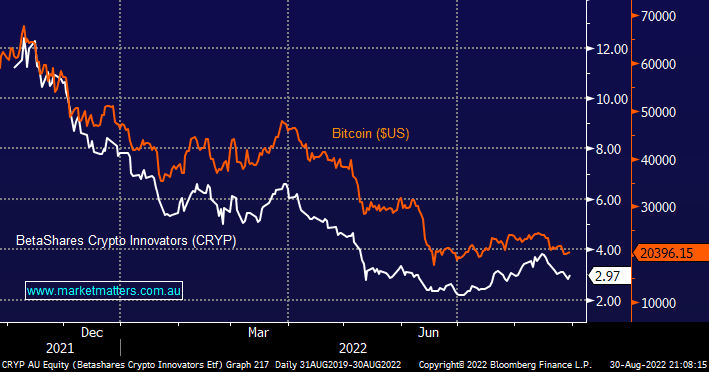

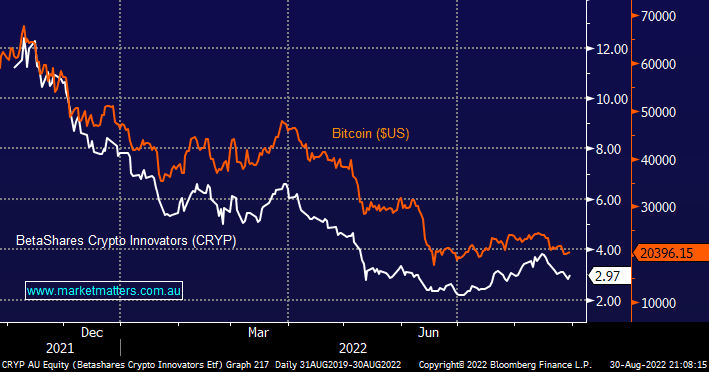

- This would be a volatile play with the CRYP ETF looking capable of doubling from below / around the $2 area but it’s an ETF that’s already halved a few times in 2002.

See comments yesterday in Crypto – Click Here

NB The CRYP ETF is an ETF that looks to track the Bitwise Crypto Innovators Index i.e. the index itself aims to track up to 50 of the largest companies involved in servicing crypto markets but as the chart below illustrates it tracks the price of Bitcoin very closely.