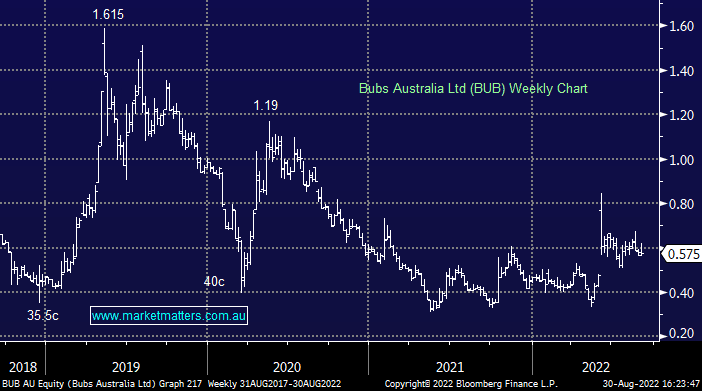

BUB -4.96%: a record year for Bubs after receiving a boost in sales on gaining US FDA approval late in the year. Revenue came in at $104m and underlying EBITDA of$4.8m were both ahead of guidance provided in July when the company raised $63m to scale up operations. Revenue from China bounced back, more than doubling vs FY21, as export restrictions to the country eased. The US made up 9% of revenue despite having received FDA approval in late May. The company is now working toward achieving permanent approval, already managing to send 800,000 tins of infant formula to the country. Plenty of positives out of FY22, however the company provided little in the way of detailed guidance which weighed on shares today.

scroll

Question asked

Question asked

Question asked

Question asked

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

Monthly Update: Portfolio performance and positioning during October

Monthly Update: Portfolio performance and positioning during October

Close

Close

MM is neutral BUB ~60c

Add To Hit List

Related Q&A

BUB & PPS – Value Propositions?

Does MM like the smaller retailers at the moment?

MM view on BUB

Current thoughts on Bubs Australia (BUB)

Relevant suggested news and content from the site

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Recorded Thursday 20th November

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Video

WATCH

Monthly Update: Portfolio performance and positioning during October

Recorded Thursday 6th November

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.