BUB had been enjoying strong growth in the Chinese baby formula market in similar fashion to A2M before Covid but over the last 2-years BUB has turned its attention more towards the US which is panning out strongly, although the company still enjoys 26% of its revenue from China sales. In July the company delivered a solid update and more financial data will be out this morning when they report FY22 results which should be helped tremendously by the US Governments emergency action to acquire much needed baby formula.

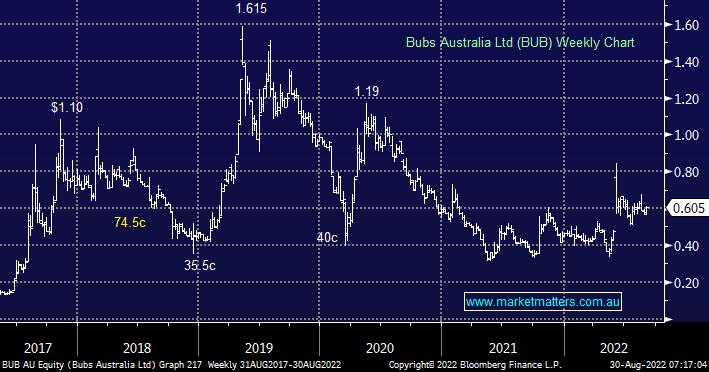

- Even after the improving operating backdrop and performance for BUB the stocks struggling to advance above 60c.

- Generally we are not keen on stocks that cannot advance on good news and this appears the case for BUB as the US appetite for its products soars – although today will be key to this interpretation.