Goldman Sachs now sees a 50% chance of Chinese stocks exiting the US as political tensions continue to simmer with Taiwan the current focal point. However 6-months ago many had the transition as inevitable so some optimism has clearly returned that these superpowers can put aside their political differences at least in the financial arena. Chinese stocks listed in the US & Hong Kong have taken some encouragement over the last few days from this improved backdrop and coincidentally yesterday right on cue we saw some positive influence from China roll through the ASX.

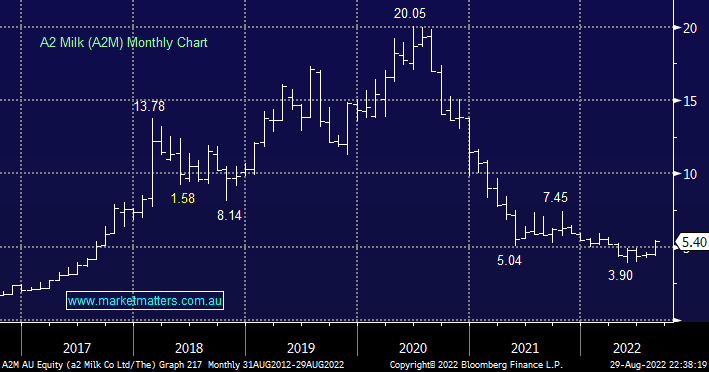

It’s been a long time since I can recall previous market favourite A2M being the market’s top performer but yesterday it soared +10% after delivering double-digit revenue and earnings growth with improved rhetoric towards China catching our eye. The company’s far more upbeat outlook toward its China infant formula market could prove the catalyst for at least a recovery in the company’s fortunes after the collapse of the Daigou distribution channel led to the stock’s painful slide since mid-2020.

- A2M also announced a $150mn buyback which helped push the stock higher squeezing the persistent ~4% shorts in the process – this position had been above 8% through much of the last few years.

- In the case of A2M we believe on balance the worst is behind the company and a bounce back towards $7 wouldn’t surprise – the risk/reward is actually very attractive.