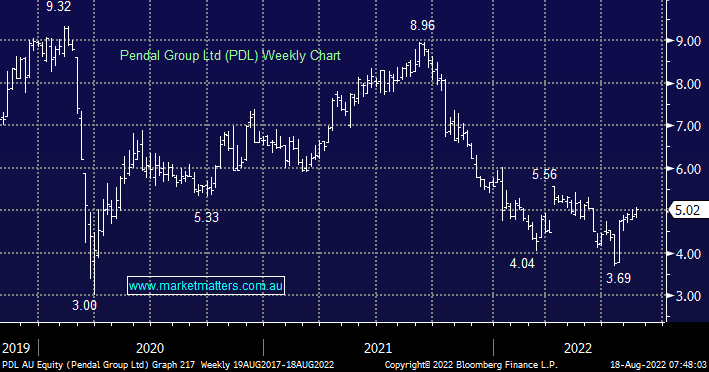

PDL has risen strongly since we purchased the stock about a month ago for our Active Income Portfolio following rumours that Perpetual (PPT) again have the $2bn business in its sights – remember in April of this year, Perpetual launched a $2.4bn takeover attempt on their similar size rival only to be rebuffed by the PDL board on valuation grounds. At the time the deal was a mix of cash and shares valued at $6.23 which is a 20% premium to where the shares closed yesterday.

Since the previous bid PDL has experienced outflows but we can still see a slightly higher bid on the horizon, both companies have downplayed the news, saying it’s highly conditional and no certainty of a deal at this stage, however, given this is now the 2nd time at the table we think it has an excellent chance of success.

- We are considering also buying PDL for our Flagship Growth Portfolio with the risk/reward looking very attractive at current levels.