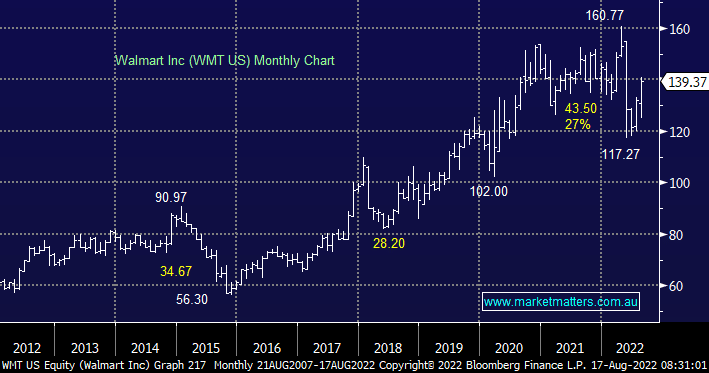

With a market capitalization of US$382bn, Walmart has a huge operation with exposure to a broad cross-section of America, its customer base looks very much like the US population. They reported quarterly earnings overnight that were better than expected and the stock rallied, but more importantly, it is another piece of evidence that suggests things are improving in the US, and this has positive ramifications for Australia.

After two recent profit warnings, the latest only 3 weeks ago, Walmart’s US same-store sales growth rose by 6.5% in the second quarter and it now expects its earnings in the year to the end of next January to decline by up to 11% — an improvement on the 13% fall it predicted in late July. Huge levels of unsold inventory were a major issue and while they are still holding ~$US60 billion of stock, that’s down from the prior quarter i.e. they are getting through it.

Why should we care? The US has led the downturn and now there are signs they are leading the recovery. After the shock of concerningly high inflation and sharply higher interest rates, we are now seeing both inflation and interest rates come down. The cost of a 30-year fixed rate mortgage in the US has now fallen over 1% from its peak. If inflation has indeed peaked, interest rates will have also peaked, and consumers will become more confident, all things we are now seeing tangible signs of.