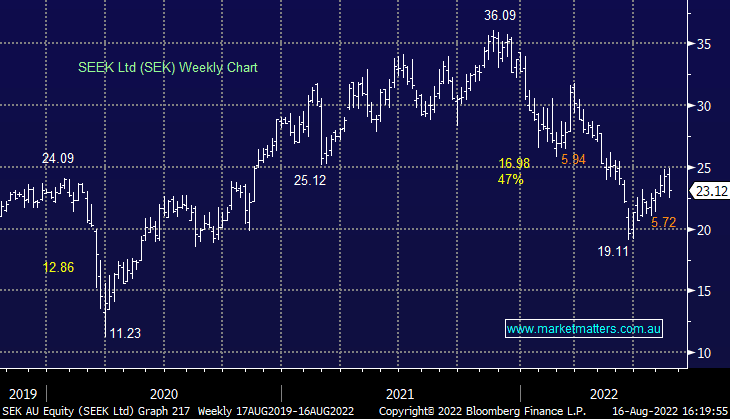

SEK –5.13%: Job ads remain at all-time highs and that set a good backdrop for SEK’s FY22 results today, with particular strength obvious in the 2H across ANZ & Asia. FY22 underlying net profit after tax (NPAT) came in a $259.6m, ahead of the $246.5m expected along with a dividend of 21cps. That was a rise of 84% on FY21, however guidance for FY23 missed the mark, SEK saying that underlying NPAT would likely be $250-$270m versus current consensus of $286.4m, about a 10% miss.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

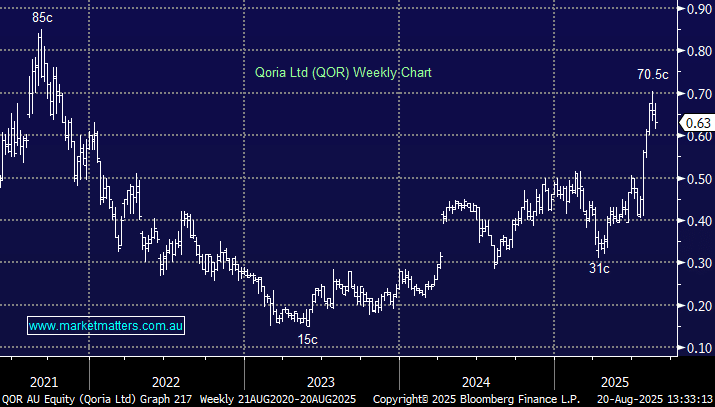

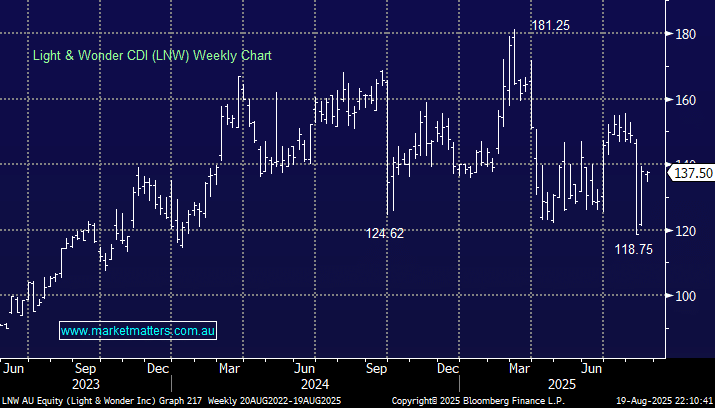

Buy Hold Sell: The best and worst performers of FY25

Buy Hold Sell: The best and worst performers of FY25

Close

Close

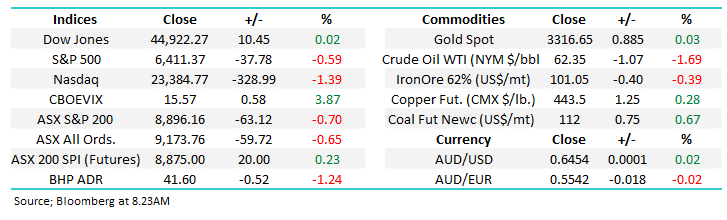

Wednesday 20th August – ASX +44pts, JHX, MFG, APA

Wednesday 20th August – ASX +44pts, JHX, MFG, APA

Close

Close

Wednesday 20th August – Dow up 10pts, SPI up +20pts

Wednesday 20th August – Dow up 10pts, SPI up +20pts

Close

Close

MM is neutral SEK

Add To Hit List

Related Q&A

Why sell and buy SEEK within a month?

What are MM’s thoughts on SEEK near $25?

How should we handle the recent rally in SEK, AD8, HUB, REA & ALL?

What’s MM’s favourite 5 stocks for short term bull run?

MM’s view on SEK & ANN

MM view on Seek (SEK)

Question on SEK

CUV and Seek (SEK)?

Relevant suggested news and content from the site

Video

WATCH

Buy Hold Sell: The best and worst performers of FY25

James Gerrish & Henry Jennings

Podcast

LISTEN

Wednesday 20th August – ASX +44pts, JHX, MFG, APA

Daily Podcast Direct from the Desk

Podcast

LISTEN

Wednesday 20th August – Dow up 10pts, SPI up +20pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.