Hi Nilang,

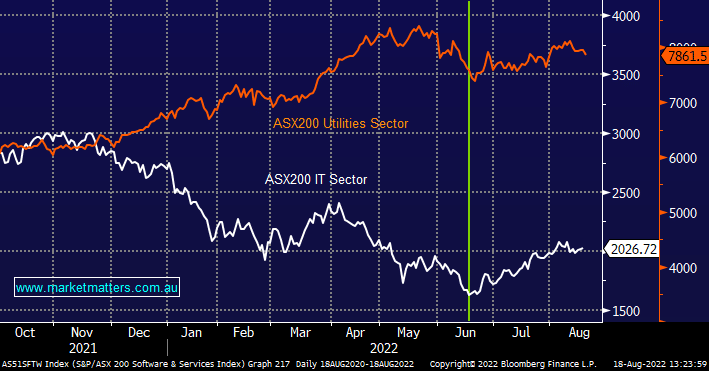

Our view around sectors is largely determined by bond yields which we believe will take another look on the upside and potentially in a number of cases make new highs multi-year. However this is not a move we’re looking to position for as opposed to using it to tweak portfolios towards lower bond yields into such a move i.e. we are looking to ultimately position ourselves for an extension of stock / sector rotation similar to how markets have performed since mid-June.

If bond yields continue to edge higher in the following weeks we expect interest rate sensitive stocks / sectors to struggle as they have been as we approach Jackson Hole:

- Real Estate, Retail / Consumer Discretionary and especially Tech Sectors are likely to pullback if bond yields test their 2022 highs.

MM is looking to fade such a move if it unfolds by increasing our exposure towards these sectors into weakness over the coming weeks / months.

- By definition if bonds and yields follow this road map the value stocks such as resources & banks should underperform over the next 6-months, or more.