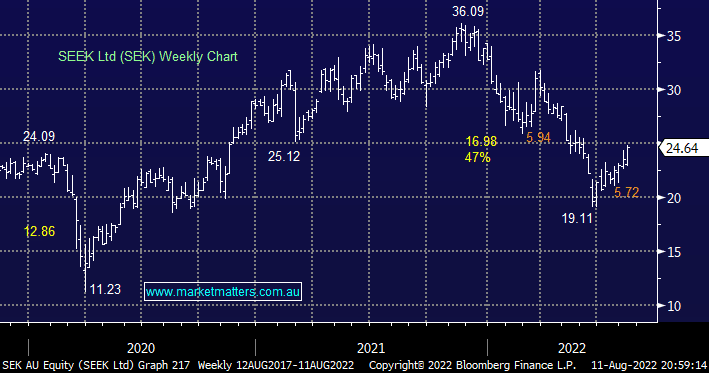

On-line recruitment giant SEK is leveraged to the economic backdrop as job advertisements slow when inflation & interest rates increase which by definition hits their revenue. However, there are other factors at play with SEK’s share price as we wave goodbye to QE and learn to live with QT i.e. high valuation stocks were aggressively rerated on the downside with SEK itself almost halving. However unlike many tech names, Seek has a solid earnings profile although analysts still have very differing views towards the stock i.e. 3 sells, 4 holds, 4 buys and 3 strong buys.

- Technically we can see fresh 2022 lows but while that feels miles away today next Tuesday’s Full Year Result could change the picture in the blink of an eye.