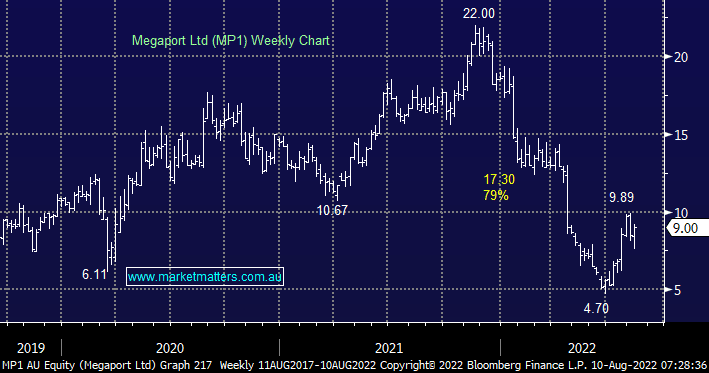

The connection services company reported FY22 results yesterday, with the stock enjoying a rally on the back of an ‘ok’ report. We have held Megaport (MP1) in the Flagship Growth Portfolio in the past, selling the position above $16, but after its recent fall down below $10, and given it is still loss-making and clearly at an early stage of its journey, it becomes a possible target for the Emerging Companies Portfolio.

Yesterday’s report was largely pre-released – Revenue and operating performance were announced at the quarterly update in July while EBITDA was a slight miss at -$10.2m. They provided colour around customer metrics which highlighted the decline in the business. While churn rates are low (~7% annualized), FY22 customers are using less than 25% of the services that a customer in FY16 was paying for, though the hit to revenue per customer is a little milder. In our view, the rally yesterday was more reflective of an unwind in the sizable short interest in the stock which was sitting around 8% heading into the result.