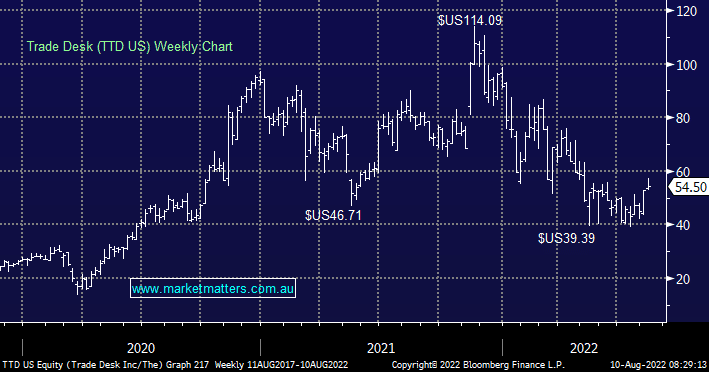

Overnight, The Trade Desk (TTD US) released a Q2 trading update after market that was stronger than expected on most metrics, while there was also some concern in the market leading into this update about the health of the broader online advertising space. This update will go a long way to allay some of those concerns and the stock should do well as a result. As a refresher, TTD is a cloud-based technology platform for advertising buyers, it has a global reach and allows advertisers to create advertising campaigns across a broad range of online mediums, underpinned by data. Think about the ads you see on streaming services, in online video content, and in apps on mobile phones and you’ll get a better feel for what TTD does.

For the quarter, revenue of $377m was up 35% from the same time last year and above the $365m expected, while they guided to Q3 revenue of $385m which was also higher than current market expectations. They also guided for adjusted earnings before tax (EBITDA) of $140m for Q3 which was also around 5% ahead of the street’s expectation. All in all, a good set of numbers against a backdrop of a nervous market.

More broadly, advertising is something that generally struggles in a recession / tougher economic times, however as we’ve seen with Google, the cream rises to the top in this space. Importantly, platforms that deliver the truth about the success or otherwise of advertising in a non-fungible, analytical way, and allow educated, trackable decisions in MM’s view will be more sort after in this tougher economic climate where spending needs to be fully justified.