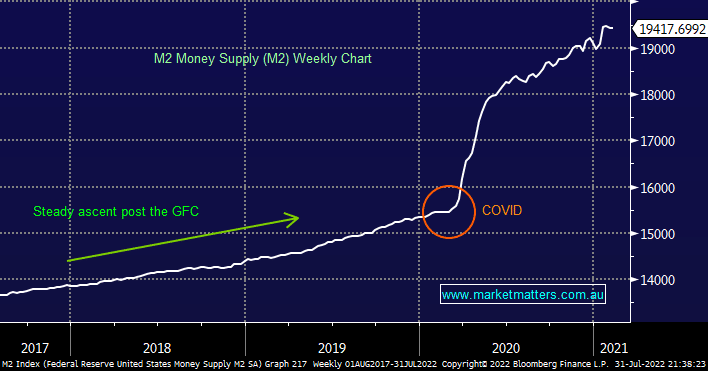

Earlier in today’s Macro Monday report, we mentioned liquidity still appearing absent from financial markets which is to be expected as we enter a period of financial tightening i.e. QT after years of very market-friendly and accommodating QE. Through 2022 we have often referred to Bitcoin as a new indicator of free cash on the street because investors/traders need “spare” money before they venture into this particularly aggressive and volatile space.

- MM believes general market valuation expansion is unlikely for the foreseeable future, it will be more of a stock pickers market where companies will need to deliver for their shares to rise.