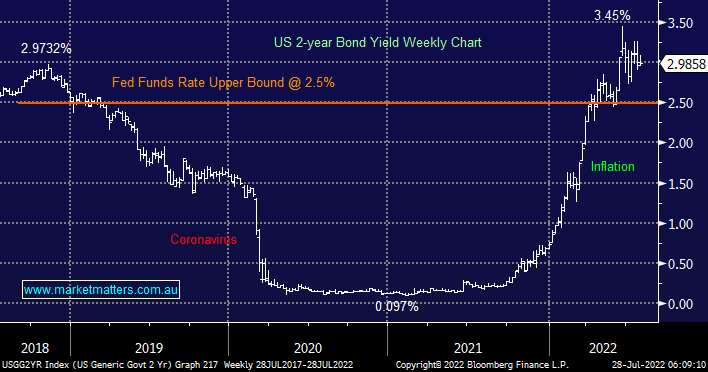

Following the FOMC meeting the Fed hiked rates 0.75% at 4 am AEST taking the upper target to 2.5%, however, the rhetoric from Jerome Powell was far less hawkish, or almost dovish, compared to what people were expecting:

- He said “the Fed will slow the point of increases at some point while adding that officials would refrain from offering clear guidance on the size of the next move”.

- The Fed argued that the US is not yet in a recession but the “R” word got some noticeable air time.

This feels like an inflection point and while the Fed will clearly remain data dependent the US 2-year yields, similar to our 3-years after the local CPI print, closed back below 3% as bets for the next tightening eased – 0.58% of tightening is now priced in for September which feels about right.