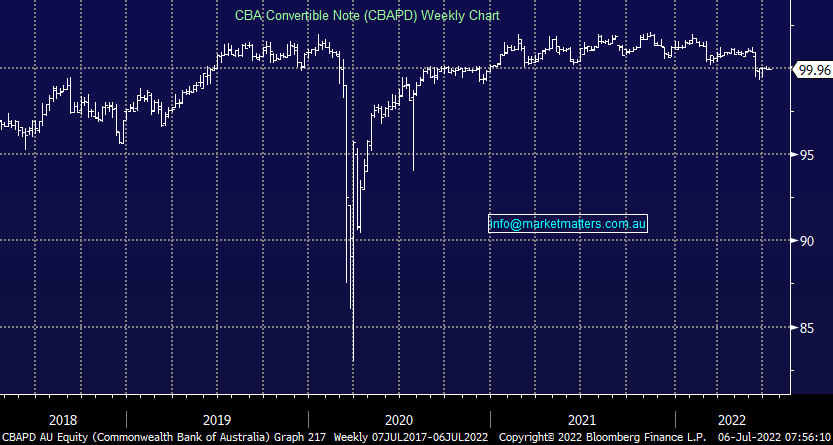

There has been a flurry of new tier 1 bank hybrids hit the market in recent weeks from Westpac, NAB & Macquarie and it would be understandable to be a little ‘punch drunk’ from these new issues all coming in short succession, however, it won’t last. The CBAPD is the final tier 1 bank hybrid that could be rolled this year while there is only one existing issue (ANZPF) that could be rolled in 2023. i.e. supply is going to tighten.

While we don’t own the CBAPD in the Income Portfolio (we own the CBAPG), the security looks attractive for low-risk income investors seeking shorter-term exposure – here’s why:

- CBA PERLS VII (CBAPD) is a large $3bn Issue size meaning it is very liquid and is callable on the 15 Dec 2022 making it a short-dated note

- At yesterday’s close of $99.96 => 6.00% grossed, annualized Yield to Call – quarterly Distributions paid on 15 Sep 2022, 15 Dec 2022.

- Its current 3.50% trade Margin is as high as longer-dated Hybrids, but only has 6 months to run.

- Floating Rate distributions – calculated at 3 month BBSW (currently 1.8163%) + fixed 2.80% Issue Margin.

- Possible option to re-invest/roll into a new security by December, otherwise expect to be Called on 15 Dec 2022 at $100 Face Value plus final distribution.

- Lack of supply next year – ANZPF only major bank hybrid Callable in March 2023.

- Distributions benefit from a higher BBSW and therefore rate hikes a positive.