Global stocks have experienced ever-increasing volatility through 2022 and while its easy to point the finger of blame directly at surging bond yields we believe the removal of liquidity is more specifically the issue although by definition they go hand in hand. What matters is where to from here so MM and our subscribers can add value (alpha) to our portfolios while both fear and opportunity increase by the week. The obvious place to start our search for answers is by reviewing the previous occasions when the Fed removed QE and its subsequent impact on stocks.

- Quantitative Easing (QE) is typically the purchase of longer-dated bonds to increase liquidity in a financial system, it flows through to greater cash held by banks which leads to greater lending and hence spending, rising asset prices, confidence etc. For the historians amongst our readers, the Japanese were the 1st to use QE back in 2001.

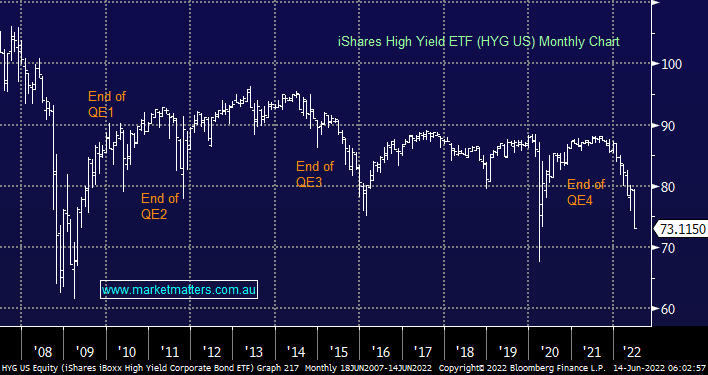

Since the GFC the often fickle Fed has stimulated the US economy with QE on 4 occasions illustrating how easily they can change their mind but the impact on equities has been fairly consistent every time they have pressed the on, or off button i.e. the greater the QE the harder that stocks have rallied. What we’ve looked at today is the simple chicken and egg relationship as we search for clues as to what leads when QE is removed, we’ve mentioned previously that Bitcoin is a good leading indicator for stocks but with the major crypto making fresh 18-months lows overnight due to its own issues we thought going to the “source” or high yielding bonds might add to our armoury of catalysts to call the future direction of risk assets through 2022 & 2023:

- During the GFC we saw high-yielding bonds bottom in March 2009, at basically the exact same time as stocks.

- In 2010 bonds bottomed in May, around 2-months before stocks.

- In 2011 bonds bottomed in October at exactly the same time as stocks as they did again in 2016 and in 2020.

High-yielding Bonds, or junk as they are sometimes referred to, are bonds that pay higher interest rates because they are backed by companies with lower credit ratings which is usually the 1st place excess liquidity is pulled from during times of uncertainty – an easy concept to understand as investors look for safe/defensive style investments making them an excellent measurement of liquidity. Unfortunately, high yielding bonds clearly move in tandem with stocks as opposed to a useful few weeks/months ahead hence all they are telling us at the moment is the same story as Bitcoin i.e. we have no countertrend buy signals yet but they will come as is always the case when panic rolls through stock markets.