Hi Bernie,

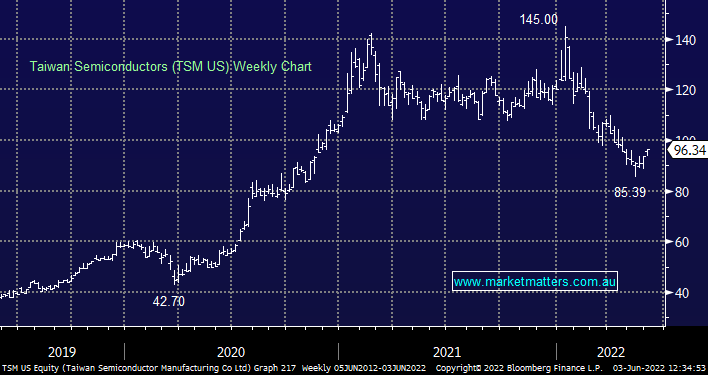

As always there are a few moving parts with share market investment, its only the first part of the puzzle to get the macro picture correct then we need to select the optimum vehicle to benefit from such a move. Lets look at TSM:

- They recently reported April revenue numbers which were up +55% year on year with the demand for chips continuing to grow.

Also TSM are reported to be looking at price hikes in early 2023 so all reads well here although the company is committed to developing the most advanced chips which comes at a very large R&D cost.

However the main factor influencing TSM’s share price has been the value contraction in the growth / tech space since bond yields started surging higher. Our take:

- TSM is an excellent business but the stock rallied too hard into January forming a classic blow-off top, up 240% in under 2-years.

- Hence the ~40% pullback from this high looks poor but in the scheme of the last few years the stock still looks good and is performing well, its simply experienced some major P/E contraction.