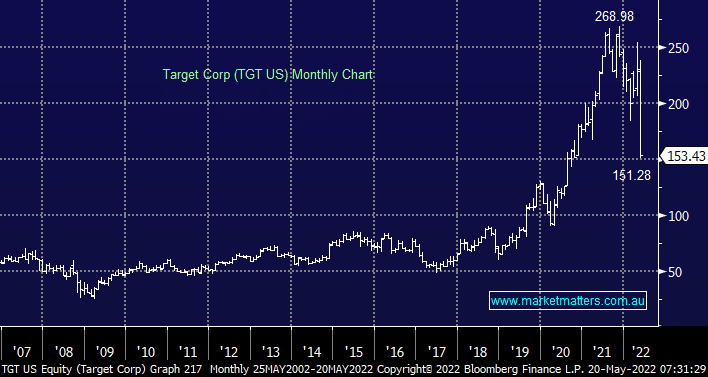

As we’ve touched on earlier Target has led a sharp pullback in US Consumer Staples stocks with the selling flowing through to similar local names plus retail stocks were also caught up in the downdraft e.g. yesterday we saw Wesfarmers (WES) -7.8%, JB Hi-Fi (JBH) -6.6%, Metcash (MTS) -6.5% and Woolworths (WOW) -5.6%. MM has successfully avoided retail stocks this year but we are holding some supermarket stocks + Wesfarmers in our Income Portfolio which as shown have been sold down this week on concerns around costs.

The market dynamic we’re considering today is whether the post lockdown pent up demand for tourism can offset the troubles in discretionary spending and rising operating costs that are starting to loom for the likes of supermarkets, theoretically, both of these headwinds will be encountered by tourism operators. Booking holidays at the moment is tough going with prices elevated and supply limited as we all want/need a break after COVID but as markets look at least 6-months ahead the question is will investors start to price in this demand starting to wane as consumer confidence is challenged by rising interest rates and talk of a recession. The influences can be split into 2 simple camps:

Positive tourism: Pent up demand, Australians sitting on mountains of cash, a great employment backdrop and borders re-opening.

Negative tourism: Rising interest rates, increasing wage pressures (arguably a positive for spending) and talks of a pending recession.

At this stage of the cycle, we believe the positives are outweighing the negatives but we also need to consider whether stocks are being priced too optimistically. Webjet (WEB) MD John Gusic certainly agrees after he gushed in yesterday’s earnings call – “Guess who’s back? Travel’s back, baby,” although they still announced a statutory loss of $85mn it wasn’t as bad as the previous 12-months $157mn.