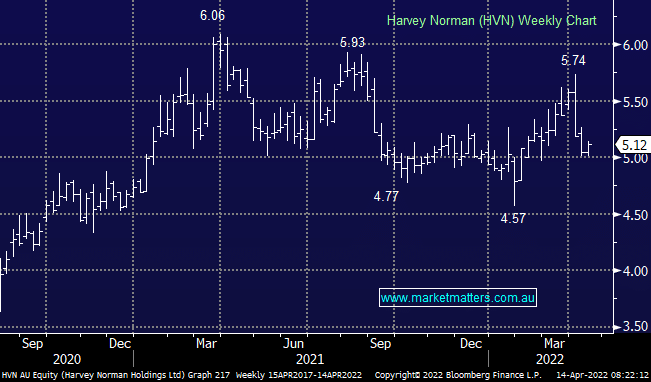

On ~11x earnings and expected to yield 6.84% fully franked over the coming 12 months it’s hard to be too negative on Harvey Norman, however, whenever I go into my local HVN to buy an overpriced printer cartridge from a graduate of Sunshine Tafe, it doesn’t fill me with confidence. HVN has a very high correlation to housing given its product mix which means 2022 will be a very good year for it, however, the outlook for FY23 is more challenging. If you want to buy a housing stock, buy Stockland (SGP) as we have this week for the Income Portfolio.

scroll

Question asked

Question asked

Question asked

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

Monthly Update: Portfolio performance and positioning during October

Monthly Update: Portfolio performance and positioning during October

Close

Close

MM is neutral HVN

Add To Hit List

Related Q&A

How does MM view retail and other sectors being sold off?

What does MM think of Harvey Normans (HVN) has significant property assets?

MM view of NEC & HVN

Relevant suggested news and content from the site

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Recorded Thursday 20th November

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Video

WATCH

Monthly Update: Portfolio performance and positioning during October

Recorded Thursday 6th November

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.