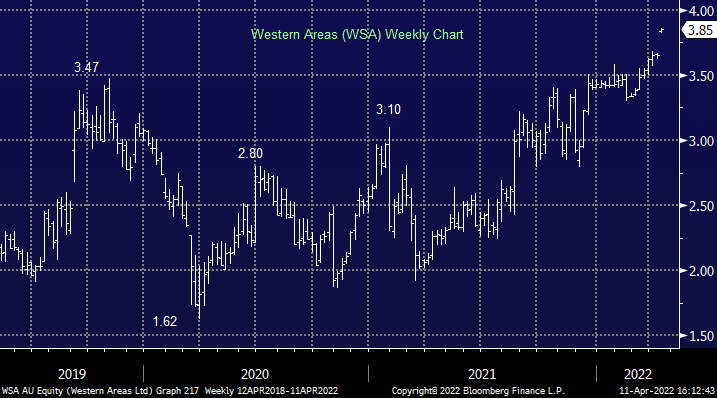

WSA +5.48%: nearly 4 months on from the initial agreed takeover price, Western Areas has managed to secure a new deal with Independence Group (IGO) 15% higher. The nickel price has rallied around 70% since the deal was struck, and an independent expert report deemed that the market fundamentals had changed forcing Independence Group’s hand to submit a new bid at $3.87/share in cash, more in line with the expert report. WSA’s largest shareholder, Andrew Forest’s Wyloo, has agreed to vote in favour of the revised terms, and so will the company’s board when the vote comes with the deal expected to be wrapped up in June.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

Monthly Update: Portfolio performance and positioning during October

Monthly Update: Portfolio performance and positioning during October

Close

Close

Related Q&A

MM’s current thoughts on WSA

How to play Australia’s Nickel names

WSA, ASM & am I too late to buy Calix (CXL)?

Western Areas (WSA)

RBL & WSA questions

Views on Nickel

Relevant suggested news and content from the site

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Recorded Thursday 20th November

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Video

WATCH

Monthly Update: Portfolio performance and positioning during October

Recorded Thursday 6th November

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.