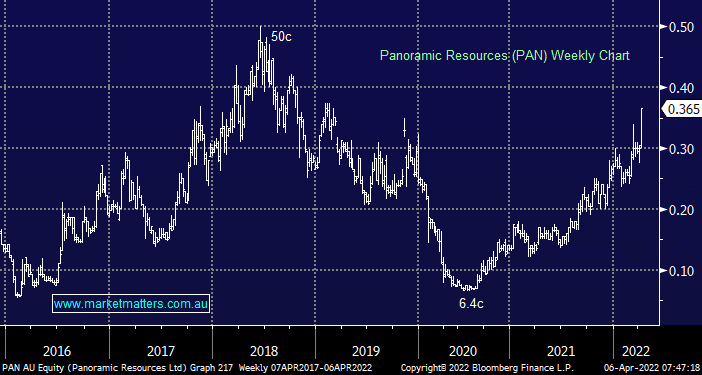

We are conscious of having a low level of resources exposure in the portfolio after taking profits on Coronado Resources (CRN). Panoramic Resources has caught our eye given the significant volatility in the nickel market over recent weeks, with prices only just starting to settle, though at much higher levels than seen throughout 2021. Panoramic is a WA based nickel-copper-cobalt miner that’s just seen its third shipment made following the restart of their Savannah project. It’s heavily leveraged to the spot market with no hedge book in place & they’re continuing to expand their resource with drilling programs underway. The largest shareholder is Western Areas (WSA) with a ~20% stake, with their own takeover from Independence Group (IGO) now in doubt, they may look to grow their own Nickel footprint through acquisitions.

scroll

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

Monthly Update: Portfolio performance and positioning during October

Monthly Update: Portfolio performance and positioning during October

Close

Close

MM is bullish PAN, and may add to the Emerging Companies Portfolio

Add To Hit List

Related Q&A

Relevant suggested news and content from the site

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Recorded Thursday 20th November

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Video

WATCH

Monthly Update: Portfolio performance and positioning during October

Recorded Thursday 6th November

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.