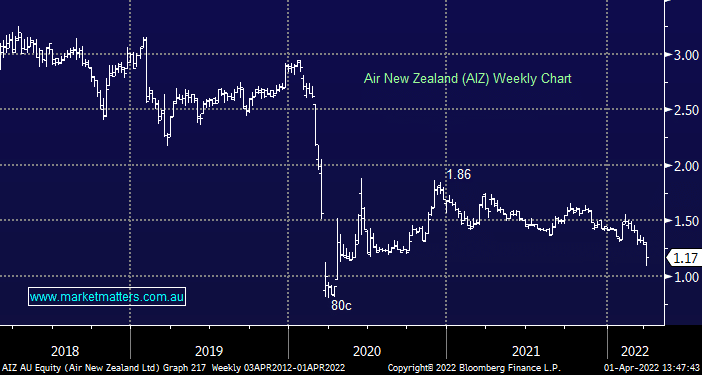

Does MM like the AIZ rights issue?

James, I am a longer term holder of AIZ. I anticipated they were going to do a capital raise as this was published, but was not expecting the offer price at a 61% discount to the market price! What are the benefits of taking taking up the offer rights of 2:1 for shares held be please? Would it be prudent to take up the rights entitlement? I am anticipating the share price to drop to at least the offer price unless I have missed something? Confused