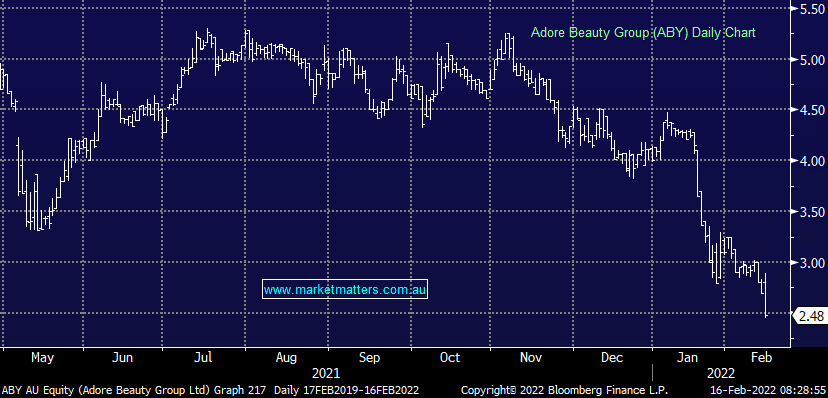

The hits continue for the online beauty retailer and after starting strongly yesterday following half year results it became clear that current run rates would mean a herculean task to meet the markets full year expectations, and the stock rolled off. The numbers didn’t look too bad – revenue up 18% to $113m was ahead of consensus and while margins took a dive it had been well flagged to the market. The issue came with YTD trading with the first 6 weeks being ‘only’ 14% higher than the start of last calendar year. On that run rate Adore will likely miss FY consensus sales by 3% as well as struggling to reach earnings forecasts as margins are low. This has been and continues to be a poor pick, and is hurting this portfolios returns. We have management in today at lunchtime and will see what they have to say, we doubt they will turn the tide!

scroll

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

MM is neutral ABY

Add To Hit List

Relevant suggested news and content from the site

Video

WATCH

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Recorded Friday 20th February 2026

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.