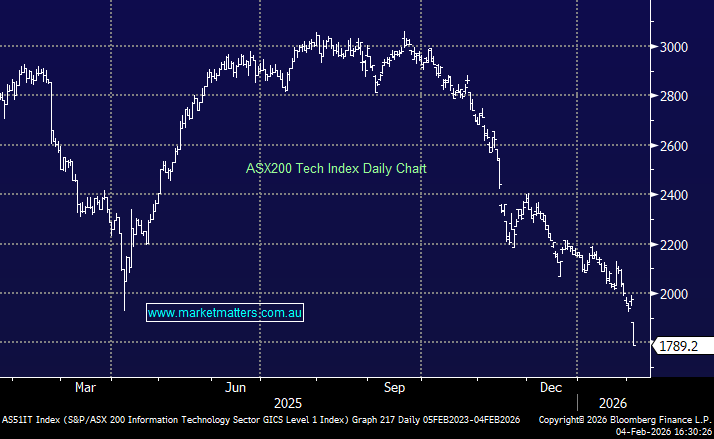

The ASX200 enjoyed a selling reprieve on Friday which allowed the market to recover over half of the weeks losses but one days bounce most definitely doesn’t herald an end to the months 11.3% plunge, at this stage we feel another test of 6700 is the more probable scenario before we can see a more sustained recovery i.e. the markets looking for as opposed to found a low.

The penultimate session for January did see almost 85% of stocks rally on a day which felt like a definite relief rally but ideally we would like to see the market exhibit some strength into “bad news” before MM would feel confident we had seen the low for Q1.