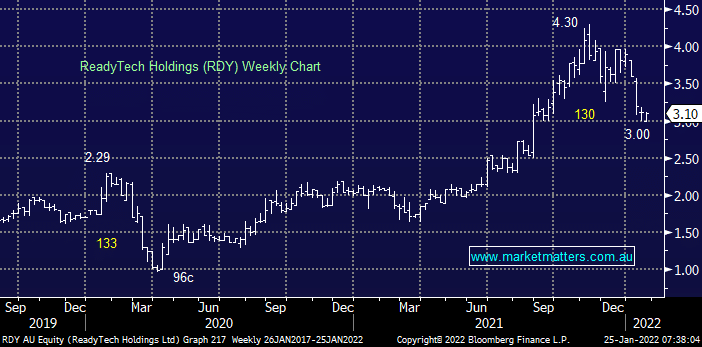

RDY offers people management software for educators, employers and facilitators across Australia and following its 30% correction we like this smaller $331m Sydney based tech business, its estimated valuation of 28.3x for 2022 is not challenging in our opinion and we think the risk / reward is excellent, a definite candidate for our Emerging Companies Portfolio. Sentiment has been mixed this month towards RDY after it failed to secure a recent government licensing project but the $8m earn out this would have delivered we believe definitely doesn’t justify the stocks fall, especially as RDY hadn’t included the tender in its FY22 guidance numbers.

scroll

Question asked

Question asked

Question asked

Question asked

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

JB Hi-Fi (JBH) historical PE multiple – source Bloomberg

JB Hi-Fi (JBH) historical PE multiple – source Bloomberg

Close

Close

MM likes RDY around $3

Add To Hit List

In these Portfolios

Related Q&A

Thoughts on ReadyTech Holdings (RDY) and IPH Ltd (IPH)

buying stocks in emerging portfolio

Which Emerging Company does MM prefer SLX, RDY or SRG?

Question on IPO’s

Relevant suggested news and content from the site

Video

WATCH

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Recorded Friday 20th February 2026

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

chart

JB Hi-Fi (JBH) historical PE multiple – source Bloomberg

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.